Understanding what tax you pay and why is essential. How much money do you actually TAKE HOME from that extra locum shift? I asked Liz Densley, FCA CTA from specialist medical accountants Honey Barrett to give us an overview of the various income thresholds that affect tax liabilities for doctors in England for the 2020-2021 tax year.

Medics who are employed under PAYE see deductions on their payslips and think that they pay a lot of tax – but don’t really consider what rates they pay, and when.

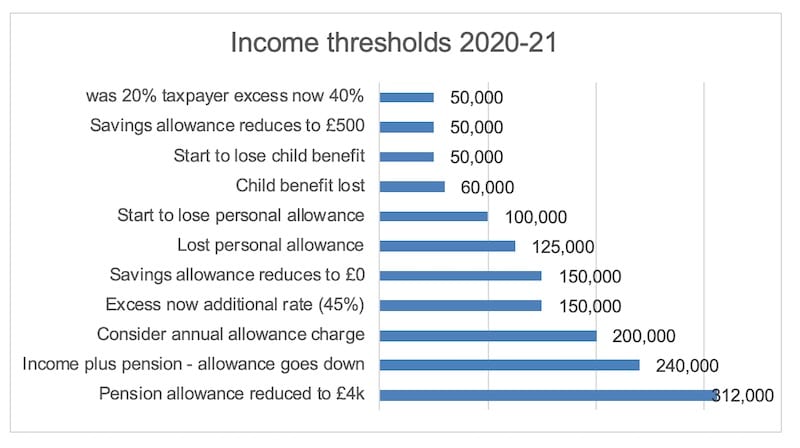

On the face of it, it is simple: pay basic rate of tax (20%) until you earn £50k then pay higher rate (40%) – but there are a large number of different income levels that you need to consider to understand the tax effect, and there are a huge number of different effective tax rates.

Tax free

Firstly, let’s consider what you can have without paying tax:

- The first £1,000 of self-employed income can be tax free. There is an automatic £1,000 trading allowance that can be used instead of claiming specific expenses if beneficial.

- The first £1,000 of property rental income can be tax free – similar to the trading allowance, if expenses are less than £1,000, the allowance can be claimed instead.

- Personal allowance of £12,500 – this amount can be earned tax free provided total income is below £100,000

- The first £2,000 of dividends are taxable at 0%

- The first £1,000 of savings income for a basic rate taxpayer, or £500 for a higher rate taxpayer is taxable at 0% (if you are a 45% taxpayer then all savings are taxed)

Effective tax rates

As income increases the rates at which that income is taxed changes:

- £50,000 taxable income before personal allowance – the level at which higher rate tax (40%) starts

- £50,000 (highest earner of a couple living together, married or not) – the level at which child benefit starts to be recouped via the tax system

- £60,000 – the level at which child benefit is fully recouped

- £100,000 – the level at which personal allowance starts to get reduced

- £125,000 – the level at which personal allowances are totally lost (note effective tax rate on the slice of income between £100k and £125k is 60%)

- £150,000 – the level at which additional rate tax (45%) starts

- £200,000 – the level at which reduction of pensions annual allowance needs to be considered

- £240,000 – income plus pension input – the level at which pensions annual allowance starts to get reduced.

- £312,000 – income plus pension input – the level at which pensions annual allowance is reduced to the minimum figure of £4,000

We have not mentioned other deductions – National Insurance Contributions, Student Loan repayments, superannuation contributions and tier rates – or ways to reduce taxable income or extend the basic rate band.

If you are close to any of these limits, it is worth seeking professional assistance to see if anything can be done – or at least to quantify what it might cost you, so you can decide whether it’s worth working more sessions or not.

We’ve set out below a couple of examples showing how much an extra £1 of income would net someone at various income levels:

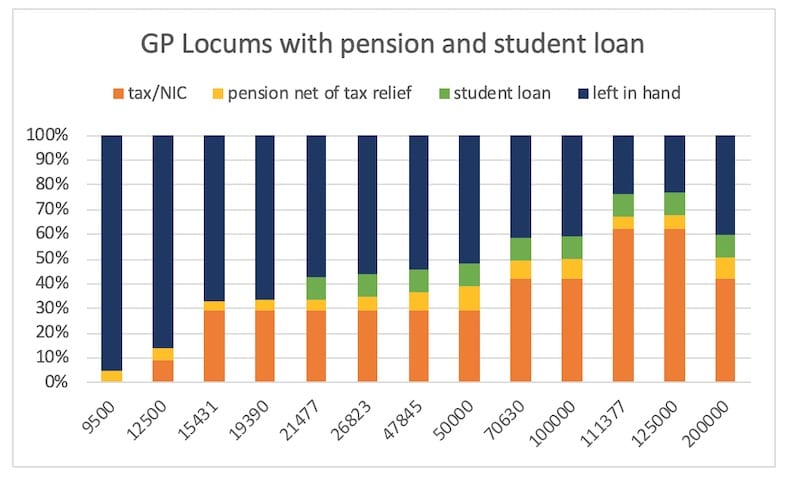

Example 1 – GP Locums with pension and student loan

A simplified example of how much is left in hand for GP locums in the pension scheme with student loan repayments (but excluding any child benefit tax may be charged and excluding any other sources of income) is shown in below

The pension contributions are based on a locum working every day; in reality, when annualisation is taken into account – where there isn’t a salaried appointment or GP Solo appointment for the whole year – then pension contributions will be higher for all income under £111,377. If you are earning between £111k and £125k then any extra effort put in will leave less than 1/3rd of the earnings in your pocket.

“What medical school didn’t teach us about money” will give doctors a step by step plan to transforming your financial future. Enter your details to download your copy nowWhat medical school didn’t teach us about money

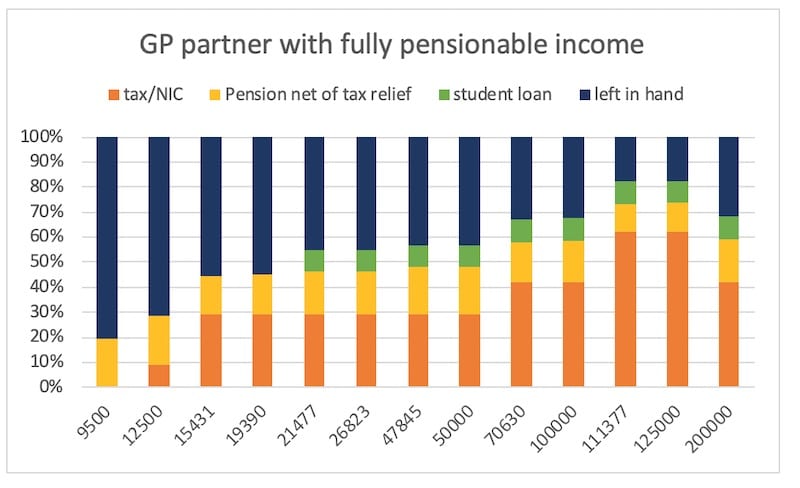

Example 2 – GP partner with fully pensionable income

As you can see, for a GP partner in the pension scheme, paying student loan repayments, between £111k and £125k of income there is hardly any net tax home pay – only about 17-18% of any extra earnings in that band will reach your pocket (bear in mind you are earning pension and paying off your student loan though). GPs will have less in hand than hospital doctors or locums because they have to fund their own employer superannuation.

Should you be in the unfortunate position of having an annual allowance charge too, it could actually cost you money to earn £1 more in that band!

A chart for a hospital doctor is harder to simplify because not all income will be pensionable and the tier rate is based on annual equivalent. The National Insurance contributions will be higher though in an employment, but the national insurance on self employed work will be lower where there is also substantial employment income.

Interaction with spouses

How income is split between spouses can make a huge difference too. For example, if one spouse earns £99,998 self-employed, before pension contributions and the other earns nothing but claims child benefit for 4 children, the net tax home pay would be £58,983.

If instead they each earned £49,999 then the joint net take home pay could be as much as £70,269! £11,285 more! A slightly contrived example perhaps, but it illustrates that tax is something to consider when deciding who might deal with childcare!

Conclusion

Understanding the tax rates that apply to your income level could make you think twice about working harder or could actually save you some tax – so don’t take it all at face value!

Liz Densley is a specialist medical accountant that can be contacted here.

Join 30,000 doctors and receive free, exclusive, financial CPD for doctors in your inbox.

Medics’ Money is run by doctors and finance experts, for doctors. Our free financial CPD gives you all the knowledge you need to take control of your finances.

The tax rates referenced in this article apply to England for the 2020-21 tax year. This article does not represent advice or guidance.