In recent weeks, the news has reported significant volatility in world stock markets. Mid-March saw both the FTSE 100 and Dow Jones experience their biggest one-day fall since 1987 before the Dow Jones then experienced its biggest weekly rise in more than 45 years.

During periods of turmoil, it’s natural that you may be worried about the value of your portfolio. However, making emotional decisions based on the news headlines can do severe damage to your financial future.

Whilst it may be hard to do, keeping calm and avoiding panic is likely to be your best option during uncertain times. Here’s why.

-

You’re investing for the long term

If you invest in equities, short-term market movements are something that you should expect and accept. Everything from inflation rates to global geopolitics can affect what happens to markets around the world and share prices will always fluctuate in the short term.

However, in the long term – and that’s what most of us are investing for – markets tend to offer positive returns.

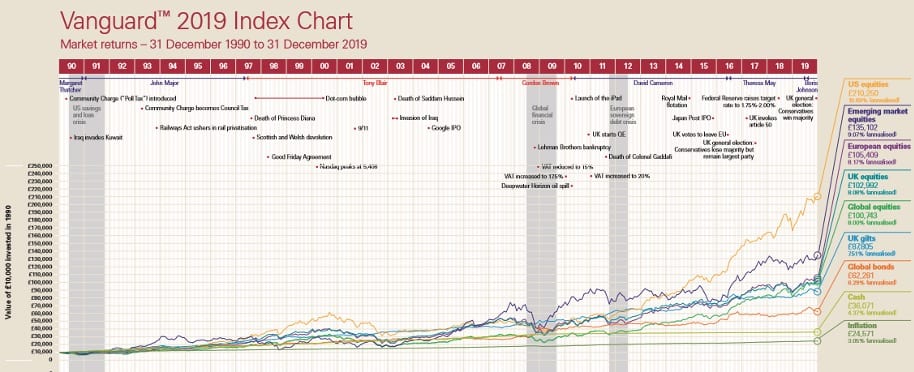

Here’s some long-term data that shows how £10,000 invested in 1990 has grown in the intervening 29 years. The chart compares the returns across a range of asset classes, including UK equities, US equities, bonds and cash.

You’ll see that despite many volatile periods – the dot.com bubble, the global financial crisis, Brexit – £10,000 invested in UK equities in 1990 was worth £102,992 on 31 December 2019, equivalent to an 8.08% annualised return.

A £10,000 investment in US equities in 1990 was worth £210,250 in 2019 – a 10.69% annualised return.

Compare this to cash, where £10,000 invested in 1990 grew to £36,071 during the same period – a 4.37% annualised return.

Notes: Cash = ICE LIBOR – GBP 3 month; global equities = the MSCI World Index; US equities = S&P 500; UK equities = FTSE All-Share; inflation = Retail Price Index, (Jan 1987=100); global bonds = Bloomberg Barclays Global Aggregate; European equities = MSCI Europe; UK gilts = ICE BofA; UK gilt (local total return) emerging market equities = MSCI emerging markets; all shown gross of taxes and of fees and in GBP. Source: Bloomberg and Factset and Bank of England, as at 31 December 2019 Note that past performance is not a reliable indicator of future results. The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Notes: Cash = ICE LIBOR – GBP 3 month; global equities = the MSCI World Index; US equities = S&P 500; UK equities = FTSE All-Share; inflation = Retail Price Index, (Jan 1987=100); global bonds = Bloomberg Barclays Global Aggregate; European equities = MSCI Europe; UK gilts = ICE BofA; UK gilt (local total return) emerging market equities = MSCI emerging markets; all shown gross of taxes and of fees and in GBP. Source: Bloomberg and Factset and Bank of England, as at 31 December 2019 Note that past performance is not a reliable indicator of future results. The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

It’s worth remembering that your long-term goals are likely to be the same as they were a month or a year ago. Investment strategies are designed with the long term in mind, and this naturally considers periods of both positive and negative returns.

- You have a diversified portfolio

The chances are that you have a diversified portfolio. Rather than holding one single stock, or all your money being invested into equities, your portfolio is spread around a range of asset classes including shares, bonds and cash. You may also be geographically diversified, with investments in the US, Europe or emerging markets.

Diversification means that a headline fall in the value of a market (for example, the FTSE 100) is typically not mirrored in the value of your own portfolio. Including so-called ‘defensive’ assets such as bonds or cash is a tactic for precisely the sort of volatile situation we have recently seen.

- Being out of the market can cost you potential growth

During periods of volatility, it can be tempting to withdraw from equities and retreat to safer assets. However, doing this means you can potentially miss out on growth as and when markets begin to recover. Timing your entry and exit from the market is almost impossible.

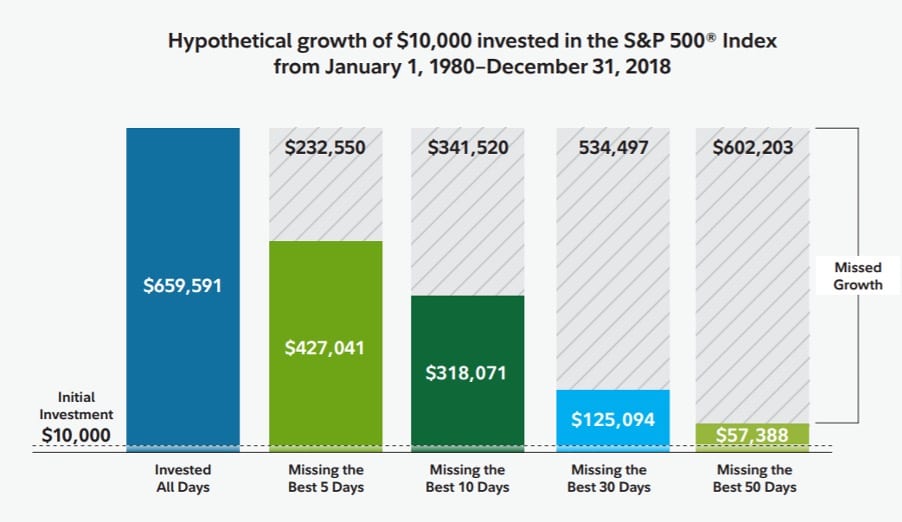

Fidelity looked at how $10,000 would have grown had you invested it in the S&P 500 Index from the start of 1980 to the end of 2018. If you had left your $10,000 invested throughout that entire period, it would have been worth $659,591 on 31st December 2018.

Source: Fidelity

If you had pulled your money out and you had missed just the best five days in the market during that period, your total investment would instead be worth $427,041. You would have sacrificed $232,550 (more than £194,000) simply by being out of the market for five days.

If you had missed the best 30 days between 1980 and 2018, your $10,000 investment would be worth just $125,094 on 31st December 2018. You would have sacrificed $534,497 (around £429,450) of gains by being out of the market for just 30 days.

Trying to time when you enter and leave the market could have a significant impact on your returns.

- You would turn a paper loss into an actual loss

Selling investments after a downturn in the market turns a paper loss into an actual loss.

Imagine that the value of your house had fallen in the short term. It’s unlikely that you would sell it immediately and crystallise your loss. Think about applying the same principle to your portfolio.

- Retreating to cash investments can see you lose out in real terms

To avoid further losses after market volatility, you may be tempted to move your investments to a place you perceive as safe — such as cash. However, this safety can come at a cost, namely ‘inflation’.

Once you factor in inflation, remaining in ‘safe’ investments while you wait for stock markets to settle down could actually lead to an erosion of purchasing power in real terms.

Source: BullionVault

Consider this chart which compares the Retail Price Index (RPI) with cash savings returns over the last decade.

In each of the eleven years shown, inflation has outstripped cash savings. This suggests that investors who are keeping their money in cash or cash equivalent savings are struggling to maintain their purchasing power in real terms.

Conversely, in seven of the eleven years, returns from shares have outstripped the Retail Prices Index.

Get in touch

If you’re a doctor, dentist, locum, consultant or other healthcare professional looking for investment advice, we can help.

You can contact Mike and his team here https://www.medicsmoney.co.uk/accountant/medical-general-ifa-ltd/

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. This does not constitute advice and advice should be sought in all instances before acting on it. Medical and General is authorised and regulated by the Financial Conduct Authority.