It’s been a little while since I completed my GP training, having qualified in August 2020, and joined my current practice as a salaried GP. Before medicine I qualified as a Chartered Accountant and a Chartered Tax Advisor and I’m aware of how many of my colleagues feel unprepared to manage their personal finances and tax affairs. While most of the VTS for GP trainees will often include some mention of financial matters – for example a discussion of GP accounts as part of a “Life after VTS” section – GP trainees don’t particularly get any help with understanding what we need to do regarding tax nor any guidance regarding our finances and money.

That’s why Tommy Perkins (who is a GP Partner) and I created Medics’ Money – to empower doctors to make better financial decisions.

In this blog we go through ten top tips that we believe all GP trainees should know (some of these may seem obvious to some of you but we believe these are all key).

Please note that the below are tips and not intended to constitute formal advice – everyone’s personal situations are different and what may be appropriate for one person may not be appropriate for another so please bear in mind that this is only, hopefully very useful, guidance.

If you find the below useful and want to learn more – including useful information for your AKT and your future as a GP – we also have a course that teaches you all about the business of GP: https://www.medicsmoney.co.uk/business-for-gps-course/

1. The basics

It’s important to start with the basics regarding the UK taxation system as this puts everything into context. In the UK the tax year runs from the 6th April one year to the 5th April the following year. At the time of writing, in August 2025 we are in the tax year ended 5th April 2026 or the “2025/26” tax year. The Government sets the tax rates, the bands at which these rates apply, and various tax-free allowances with reference to these tax years and will announce in advance what the rates and allowances will be for all the UK’s taxes from Income Tax and National Insurance Contributions to VAT and Capital Gains Tax.

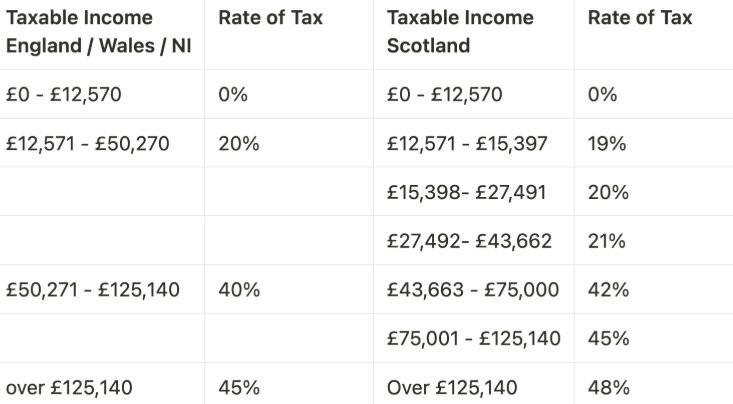

The current income tax rates for employment income outside of Scotland are 20%, 40% and 45%, depending on your level of income, while in Scotland there are more rates at 19%, 20%, 21%, 42%, 45% and 48%. There are different income tax rates for savings income and dividend income.

The vast majority of individuals living in the UK will get a tax-free allowance each tax year, which is £12,570 for the 2025/26 tax year (this is expected to be frozen until at least 5 April 2028 and likely longer). Once an individual’s income exceeds £12,570 income tax will be payable.

After the end of the tax year on 5th April, in May, your employer as of the 5th April will provide you with a document called a P60. This is really important as it details your taxable employment income in the whole tax year as well as how much income tax, National Insurance and student loan you have paid. If you leave a job during a tax year, your ex-employee will send you a P45 which tells you your taxable income and income tax paid to the date you left.

2. Keep all important tax documents!

This may seem obvious, but it really is crucial for you to keep all the documents you receive regarding tax. It’s easy to get into bad habits and not do this as you go along but please do keep every payslip, P45 and P60 you receive from your employers. These are vital to check what income you are receiving, what tax, pension and National Insurance you are paying and what your tax code is doing (see below). And they may have other important uses e.g. you may be asked to provide your P60(s) in order to secure a mortgage.

If you still receive documents like payslips by post then keep them all in a folder or scan them onto your computer. Most people nowadays will be sent these records electronically however making it easier to store them somewhere safely on their computer. For those who have access to the “Electronic Staff Record” (“ESR”), this should show all your payslips, P60s and P45s while you retain access to it. Keep saving these electronic documents to your computer every time you get a new one.

On the ESR you can also find your “Total Reward Statement” gives you your pensionable earnings statement showing the current value of your pensionable earnings and your pension earned each year. Every time you see one of these on your ESR, save it somewhere. You may not need it now but you will one day!

When you qualify, if you become a salaried GP, you will be sent payslips from your GP practice (mine are emailed to me). If you become a GP Partner, things are very different as you will receive drawings and a share of the Partnership’s profits.

3. Set up a Personal Tax Account (“PTA”)

Every single taxpayer can set up a Personal Tax Account and if you haven’t set one up we would thoroughly recommend doing so as soon as possible. People who have listened to our podcasts will know that this is something I regularly talk about and I’m going to continue doing so until every doctor has set one up!

The Personal Tax Account tells you the information that HMRC have about you – for example in terms of your expected income and what job(s) you are working. If you have locumed before, even if only briefly, HMRC may decide you now have two jobs and think you owe more tax than you do. The PTA includes an estimate of what HM Revenue and Customs (“HMRC” – the government body responsible for collecting taxation in the UK) estimate your income tax bill will be and what your Tax Code is currently (see below). If your tax code is wrong you can use the Personal Tax Account to change it (again see below) and you can use it to claim those all-important tax-deductible expenses for doctors (see below.)

To set up your Personal Tax Account, if you haven’t already, you can go here: https://www.gov.uk/personal-tax-account

4. Check your tax code

This is another favourite subject for us at Medics’ Money – you can find lots of information on this subject on our website so we will keep it brief here.

Your tax code is calculated by HMRC and issued to your employer. It tells your employer what allowances you are entitled to (in a code format so they won’t know any exact details about your tax affairs) and they can then use that to calculate how much income tax to deduct from your monthly salary. This is the way the Government collects tax from you so if your tax code is wrong, your tax bill is wrong and it is easy to then overpay tax (or underpay tax, it’s not a one-way street). It’s important to get your payslips and P60s and check what your tax code is. You can also find it in your PTA which will also give you details of what the tax code is broken into; if it is wrong you can use your PTA to tell HMRC that it is wrong.

For most people in the UK their tax code will currently be 1257L. It may be higher than this if you are getting other allowances or lower e.g. if you owe HMRC money.

In some instances, HMRC will apply an “Emergency Tax Code” which usually results in the tax-free personal allowance being taken away. Doctors may see:

- BR which will automatically tax all income at the basic rate of tax, currently 20%

- D0 which does the same thing but taxes all income at the higher rate of 40%

- 0T which takes away your personal allowance but unlike the above does not apply a flat rate

These are almost certainly incorrect for you as a GP trainee – if on your main payslip (they may be appropriate if on a locum payslip – so if you find one of these on any of your payslips you should get it changed.

To find out more about what tax codes are and how to change your tax code if it is wrong we have a blog here to answer all your questions: https://www.medicsmoney.co.uk/is-your-doctors-tax-code-correct/

5. Claim a tax deduction on your professional expenses – including exams

This is another favourite topic of ours at Medics’ Money and again we have lots of resources on claiming professional expenses for doctors. A lot of the professional expenses we incur as GP trainees are deductible against our earnings which will then reduce our income tax bills. These include our GMC fees, our medical indemnity insurance to the MDU or MPS, fees paid to the BMA and payments to the Royal College of GPs. This includes fees incurred for the RCGP exams – so you can claim a tax deduction for the AKT, CSA, RCA or SCA (top tip: when you do claim for these record their full name rather than the acronym to avoid HMRC getting confused, which is sadly all too common.) For GP trainees, claiming a tax deduction for professional expenses can save you up to 40% (42% in Scotland) of the cost back.

Just like in point 2, we would recommend keeping all receipts of professional expenses incurred e.g. when the GMC email you with a receipt, save it somewhere easily findable. You will need the receipts to make the claim.

When the time comes for you to make a claim you can download a free handy step by step guide via our website here: https://www.medicsmoney.co.uk/free-guide/

Also listen to our tax-deductible expenses podcast for more information.

6. Locuming down the line

Once you have qualified you may decide that you want to become a Locum GP. If so, you have various options for getting paid – via direct engagement with your GP practice (i.e. via a salary each month), via a limited company or, unique to GP locums, via self-employment. These all have various pros and cons, including how much admin is involved and the impact on your NHS pension – this is a huge topic and we will only consider some of the many important points here. But if you would like to read more on this topic you can find more information here:

https://www.medicsmoney.co.uk/locum-gp-guide-tax-pension-expenses/

If you receive a salary from a GP practice there will be little difference to how things work currently as a GP trainee.

If you decide to locum as a self-employed individual, and invoice the practices you work for yourself, you will need to keep accounts (though these do not need to be filed – they are for your records and tax purposes), file a Self-Assessment tax return, and will be responsible for paying Income Tax, National Insurance (NIC), student loan payments and pension contributions. Payment of Income Tax and NIC is made under HMRC’s “Payment on Account” system which is something to watch out for. See the blog referenced above for more information. Doing your own accounts and tax return can be time consuming and confusing so again you may wish to consult one of Medics’ Money’s Specialist Accountants.

You could also consider invoicing through your own limited company. Setting up as a company is often thought of by people as being tax advantageous but many of these advantages have been eroded by the government over time and it may be a disadvantage. Companies are separate legal entities and there is an admin burden here as accounts will need to be prepared and filed with Companies House and Corporation Tax Returns will need to be filed with HMRC. Tax payments will need to be made and of course you will need to get the money out of the company somehow with resultant tax consequences. If you consider this option we would recommend getting an accountant to help with this.

7. Locuming and pensions

Self-employed GP locums are able to contribute into the NHS pension scheme for their GP locum work if they are on the medical performers list and undertake locum work directly for NHS GMS, PMS or APMS practices. You must complete locum forms A and B and 90% of your gross locum earnings is pensionable (they assume that 10% of your income is needed for expenses). The GP practice will also have to pay pension contributions at 14.38% of the 90% pensionable amount which you will need to forward to PCSE (or the local health board in Wales) with your own contribution via forms A and B. Note that the Treasury will add some extra money into the pot, topping the 14.38% that your employer pays up to 20.68%

In Scotland and Northern Ireland the employer contribution is paid by your primary care organisation and the employer contribution will come out at 22.5% so slightly higher than in England and Wales.

You can only pension locum work that was carried out less than ten weeks ago (so past ten weeks you cannot pension the locum work). You must return forms A and B and your contribution by the seventh day of the month following the month that the pay was earned. So, payments received in November must be pensioned by 7 December. You can opt out but think really, really, carefully about this!!!!!

8. National Insurance Contributions

You can find lots of useful information in our National Insurance Contributions (“NIC”) blog here: https://www.medicsmoney.co.uk/national-insurance-doctors/

The main points to mention are:

- NIC is charged against salaries for employed doctors (“Class 1 NIC”) and against profits for self-employed individuals (“Class 4 NIC”). As an employee, in the 2025-26 tax year, the first £12,570 of your salary will be free from NIC but between this amount and £50,270 NIC is charged at 8%. Above £50,270, 2% NIC is charged.

- Later on, if you become a self-employed locum GP (or a GP partner), you will pay Class 4 NIC on your profits. The first £12,570 of your taxable profit will be free of NIC and between this and £50,270 the rate is 6%; above £50,270 the rate is 2%. Your Class 4 NIC payment is made at the same time as your income tax payments.

- There is also Class 2 National Insurance for the Self-employed but for most people this has been abolished.

- Note for completeness that companies do not pay NIC but if a salary if paid out of the company in order to extract money out of the company, the employee may have to pay Class 1 NIC as above and may also need to be paid.

Employer’s NIC

9. Partnership accounts

It’s never too early to think about the future and as a GP trainee you may wish to consider becoming a GP Partner in due course. If you do decide this it is very important that you look at the accounts for the GP practice you wish to join as a partner. For more information to help you with this you may wish to check out this blog:

https://www.medicsmoney.co.uk/how-much-do-gps-earn-and-should-i-join-a-partnership/

If you do become a partner, you might want to consider our New to GP Partnership Course as this will give you all the financial foundations for running a successful GP Partnership:

https://www.medicsmoney.co.uk/gp-partnership-programme/

10. Get an accountant … when you need it

As a GP trainee you are probably unlikely at this stage to need an accountant although some of you may have special circumstances which will mean you need an accountant (e.g. if you are lucky enough to rent out a property, for example, you may want an accountant to help with completing your tax returns). You can do a lot yourself and at Medics’ Money we really want you to feel empowered to do this. We have a wealth of resources on our website to help you with this. If you need to get your tax code changed, or you want to claim those tax-deductible expenses, you can do this without paying an accountant. We’ve done our best to make our website as simple and helpful as possible so that you all feel able to do this. You’re all doctors, you’re all very clever people, you CAN do it!

But down the line, you may get to the point where an accountant would be very beneficial. Maybe you’ll locum and want some help preparing accounts or maybe you get to the point where you want to consider setting up a company or want help structuring a side-business of some sort; maybe you need to file a Self-Assessment tax return and would like someone to help with that. And, of course, way down the line you’ll experience all the joy and fun of Pension Taxation and will want an accountant to help with that. For all these reasons and more you will want an accountant. A good accountant will often save you more money than you spend on them.

If you do decide you want to get an accountant, we have a number of Specialist Medical Accountants who would be happy to help and you can find one here:

https://www.medicsmoney.co.uk/medical-accountant-search/

Don’t forget, if you are interested in learning more, including the financial skills required to be a GP then check out our Business for GPs course here: