GPs are taught plenty of clinical medicine. But GPs are taught almost nothing about the business and financial skills needed to be a GP.

Hi there. I’m Dr Tommy Perkins, an experienced GP Partner and I’m Dr Ed Cantelo a GP AND a Chartered accountant and Chartered Tax adviser.

As GPs ourselves, we know how little you get taught about the business and finances of GP. Which is why we built this course.

We will teach you the essential financial and business aspects of being a GP.

The Medics’ Money Business for GPs course will set you up for a happy, profitable and rewarding career as a GP.

Our course

Is available online and can be watched anytime, anywhere on our app.

Is delivered by experienced GPs and experienced specialist medical accountants.

Covers the curriculum requirements set out by the RCGP for GP trainees.

Contains optional MCQ’s to reinforce learning and prepare for the AKT.

Is eligible for NHS funding via your training hub or by using your study leave budget.

Apply now to get access to the course.

Already signed up to the course? Click here to log in.

The course is designed for all GPs, and is especially suited to GP trainees, salaried GPs, locums and practice managers. If you are a partner the course will give you a base level of understanding but we have another course that is more suitable for partners https://www.medicsmoney.co.uk/gp-partnership-programme/

For GP Trainees the course covers the business and finance RCGP curriculum requirements and includes exam questions to test your knowledge as you go along. Up to 10% of the Applied Knowledge Test is on organisational structures that support general practice including the business aspects that our course teaches.

As GPs ourselves we know how busy you are so the course is accessible 24/7 online and our app allows you to access the course on the go at a time that suits you. Our app also allows you to interact with us and other participants, ask questions of the experts and access bonus material.

As well as covering the curriculum requirements set out by the RCGP our course also gives you practical tips from experts who have worked as or with GPs for years.

The full curriculum is here:

Module 1 – Introduction to the UK Tax System. Understanding the tax you pay and why and how to use this knowledge to make sure you don’t pay too much tax.

The NHS Pension is one of the best investments you can make. But it’s important you understand it and the checks you need to make. We also include a step by step guide to correcting pension mistakes.

Our faculty includes GP Partners, Specialist Medical Accountants, Specialist Medical Financials adviser, Lawyers who specialise in GPs, GP Property experts, GP wellness coaches and practice managers. Medics’ Money is unique in that we have all the best advisers available, so you get the very best information from leaders in their fields.

The course is self paced – you start when you are ready and you have 3 months to complete the modules. It will take you approximately 4-5 hours to complete the course.

The course costs £144.00

Apply now an we will give you details of how to access funding.

If your practice are paying it will cost them as little as £8 (after tax deductions) per partner to send you on our course.

In many areas our course is funded by training hubs. Alternatively, subject to approval the course can be funded by your study budget. Apply now and we will send you a template letter to support your application.

Many forward thinking ICBs and training hubs provide our course to help improve GPs financial wellbeing. Apply now and we will contact you with more details.

Our course can be paid for in a number of ways.

We work with many local training hubs who fund the course for their trainees.

If you apply now we will email you details of how to fund the course.

Accountants are great (Medics’ Money was founded by Dr Ed Cantelo who is not only a GP but also an accountant) but they’re not GPs. Our course combines the technical knowledge of our specialist medical accountants with the practical knowledge of our experienced GP team. The Medics’ Money team has taught thousands of GPs and we understand the issues you face and the knowledge you need to know.

The Medics’ Money course covers the RCGP curriculum requirements AND more.

How to make better financial decisions. Once you understand how GP contracts work and the tax you pay and why, you can use this knowledge to make better business decisions.

Practical Application: Theory is great but our course combines the technical expertise of accountants with the practical knowledge of experienced GPs to deliver you practical strategies and actionable insights that you can immediately apply to your financial situations.

Expert Guidance: GP is a complex business and unfortunately theres lots of misinformation online. Our course is taught by experts at the top of their game.

Networking Opportunities: Our online community allows you to meet and learn with your peers and interact with industry professionals, fostering a community of support and collaboration.

Time-Efficient: As GPs ourselves we know how busy you are which is why the course can be accessed 24/7 via our app. You can learn in bitesized amounts at a time that suits you.

Continued Support: Our community offers you the option to get ongoing support as your career progresses.

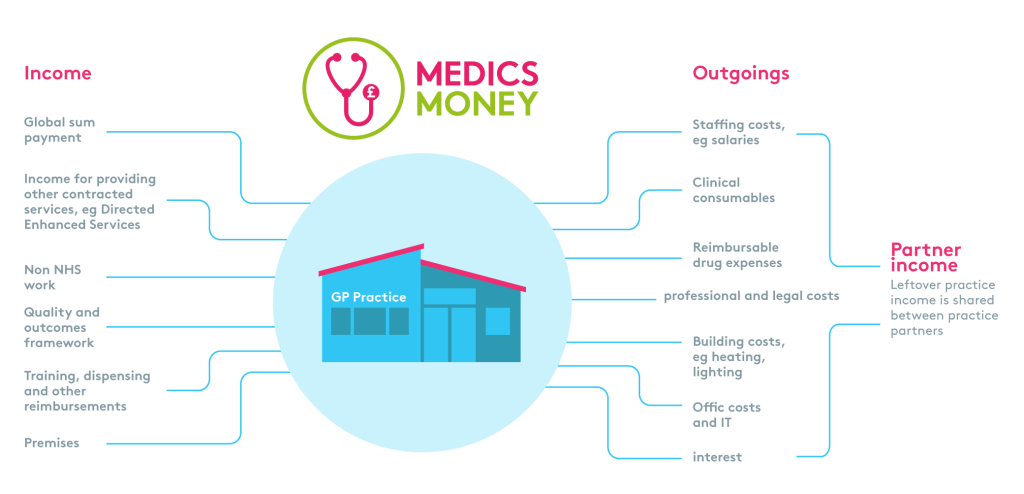

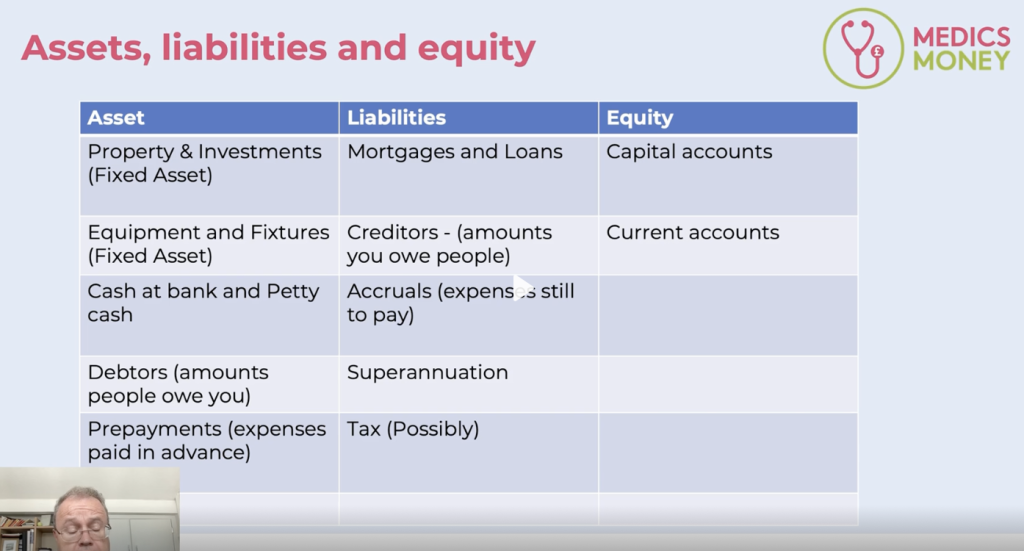

Our course is taught by experts who use clear infographics to make the complex topics easy to understand.

Unlike yawn inducing mandatory training courses, our course uses bite sized videos to give you succinct explanations and real world practical applications of the knowledge.

As well as covering the curriculum requirements set out by the RCGP, our course also gives you practical tips from experts who have worked as or with GPs for years.

If you are interested complete the form below and we will get back to you.

Look what these GPs learned on our previous courses..

I’m Ed and I’m not only a GP, but also a Chartered Accountant and Chartered Tax adviser. This unique skillset allows us to deliver the very best financial training to my GP colleagues. I specialise in Tax issues and have recently adopted two rescue cats.

I’m Tommy and I’ve been a GP Partner for several years now. As cofounder of Medics’ Money I’ve learnt so much from Ed and the other experts at Medics Money which helped me settle into my partnership. I want all GPs to get the benefit of this expertise so we set up Medics’ Money. In my spare time I enjoy spending time with my family and surfing waves.

I’m Andy Pow and I have over 20 years’ experience in medical accounting. My specialist areas include appraising the performance of GP practices, changes in GP structures, and the NHS pension scheme. As well as working at Medics’ Money I’m also a board member of the Association of Independent Medical Accountants(AISMA) and a leading commentator on healthcare issues. In my spare time I enjoy hill walking in the lake district with my wife, who is a GP.

This pre-course assessment gives you an idea of what the course covers. Don’t worry if you answer mostly 1-2’s, by the end of the course you will be 4-5’s