UPDATE: As of 14 October 2024, you can no longer change your professional expenses as below. Instead, you need to fill out a P87 form (see our guide for more details) with receipts.

The below is retained since HMRC intend to reinstate the previous system in future, but please do not use your Personal Tax Account to change your expenses at this time.

How to change your professional expenses online.

If you are here, we are assuming that you already have a Personal Tax Account and have downloaded our guide on how to use it.

If you are claiming one off expenses, such as exams or claiming for multiple years then you should use the method outlined in the tax guide you downloaded.

Click here to download the latest version https://www.

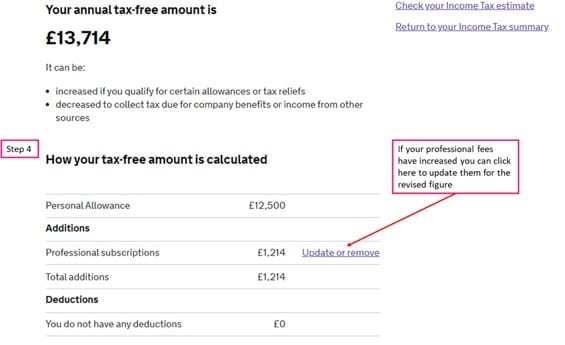

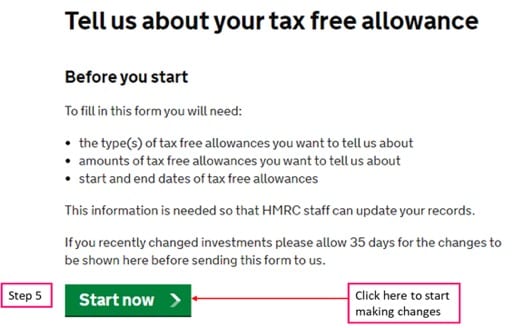

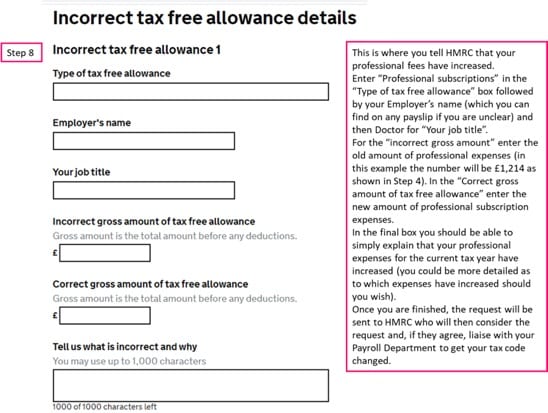

Below we will guide you through how to check your professional expenses within your tax code on your Personal Tax Account and how to request that HMRC change these if your professional expenses have increased (or indeed decreased).

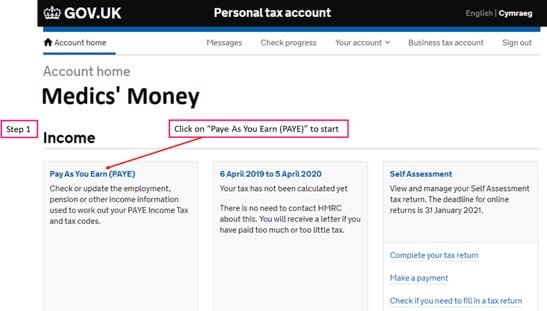

To start, log onto your Personal Tax Account then follow the steps below.