Understanding your doctor’s tax code

Your tax code is calculated by HM Revenue and Customs or “HMRC” and is used by your trust’s payroll to determine how much income tax you should pay.

In the first part of this guide we explain the basic anatomy of your tax code. In the second part we show you how to correct your tax code online yourself.

Part 1 – Anatomy of your doctor’s tax code

The tax code is made up of a number followed by a letter and, at its most basic, is simply the personal allowance divided by ten followed by the letter “L”.

The personal allowance for the tax year ending 5 April 2025 is £12,570. This means that the first £12,570 of your income in the tax year is tax free. This £12,570 is split evenly throughout the year so you will get 1/12 of £12,570 each month.

If you have one job and no extra income or allowances altering the code, the current tax code for year 2024-25 should be 1257L, given that the current personal allowance is £12,570.

You will also see the word “CUMU” which means that you get a chunk of your personal allowance each month. Your tax code can be found on your payslip.

If you are a doctor on a tax code 1257L you are receiving your full personal allowance but note that you are almost certainly paying too much tax.

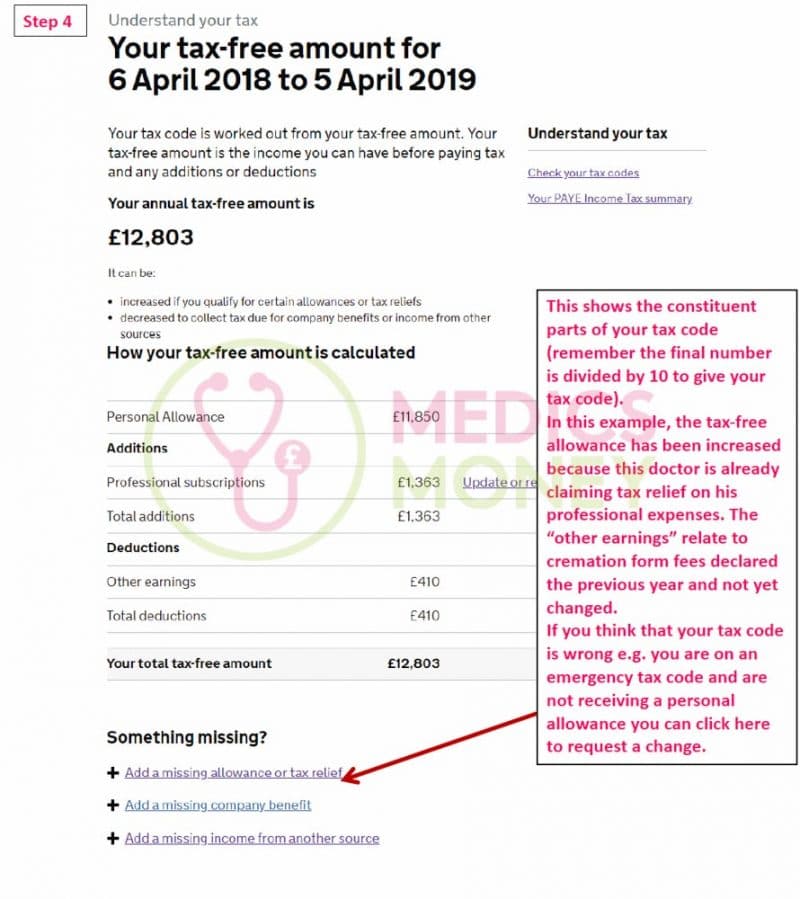

The reason being you can claim a doctors’ tax rebate on professional expenses such as GMC fees, indemnity insurance and Royal College fees. This can potentially save you 45% of any professional fees you pay, or 48% in Scotland.

Download our free step by step guide to claiming a doctors tax rebate.

Is my doctor’s tax code wrong?

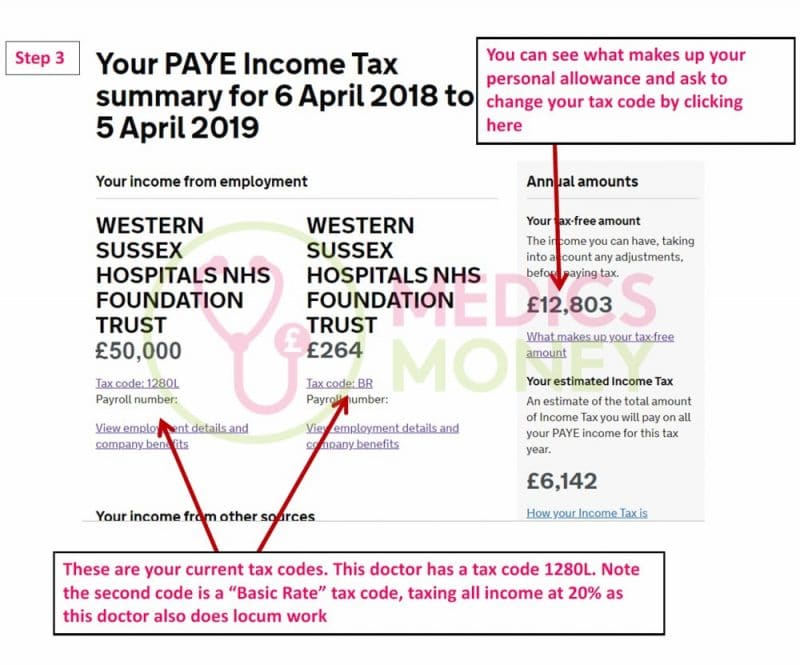

A big problem for Doctors is that it is not uncommon for HMRC to tell your payroll to apply the wrong tax code. As we switch jobs in, say, August we will usually receive a payslip from our old employer and our new employer, confusing HMRC into thinking that we are working 2 jobs. If they suspect this, they will likely apply an emergency tax code such as

- D0 NONCUM which will automatically tax all income at the higher rate of tax, currently 40%, with no personal allowance at all resulting in a higher income tax bill.

- 0T where the tax rates are applied (say 20% and 40%) but again with no personal allowance

- BR NONCUM where a 20% rate is applied with no personal allowance

Note these tax codes may be OK on a locum payslip but should not be appearing on your main payslip.

If your tax code is wrong this could be a costly error: losing your tax-free personal allowance will almost inevitably result in higher tax bills until the tax code is corrected. We would thoroughly recommend keeping an eye on your tax code to ensure you are paying the right amount of tax.

Read on to Part 2 where we guide you through how to correct your tax code online yourself.

What medical school didn’t teach us about money

“What medical school didn’t teach us about money” will give doctors a step by step plan to transforming your financial future. Enter your details to download your copy now

Part 2 – how to change your doctors tax code online

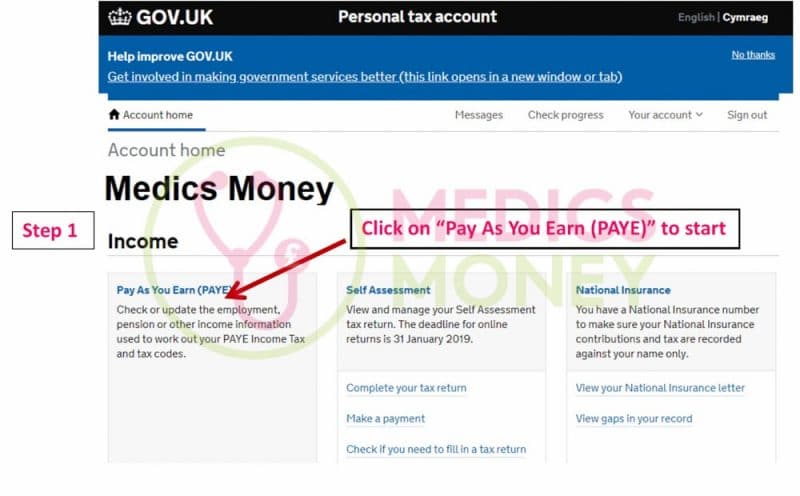

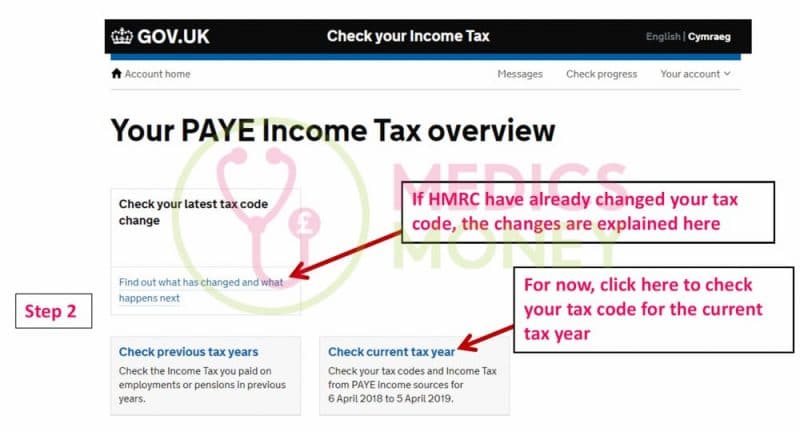

If you are here, we are assuming that you already have a Personal Tax Account. If you do not please go here to set one up.

Below I will guide you through how to check your tax code on your Personal Tax Account and how to request that HMRC change it if you believe that your tax code is wrong.

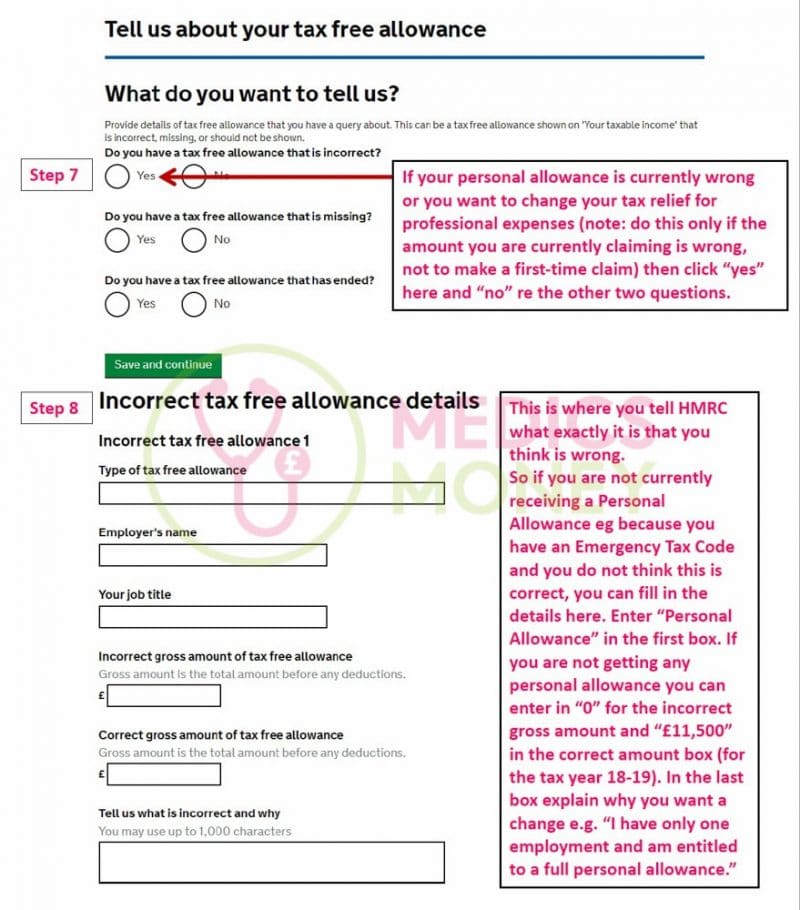

Note that there are many reasons why someone may want to request a change to their tax code – this guide considers a case where the doctor is receiving an incorrect personal allowance because they currently have an “emergency tax code”.

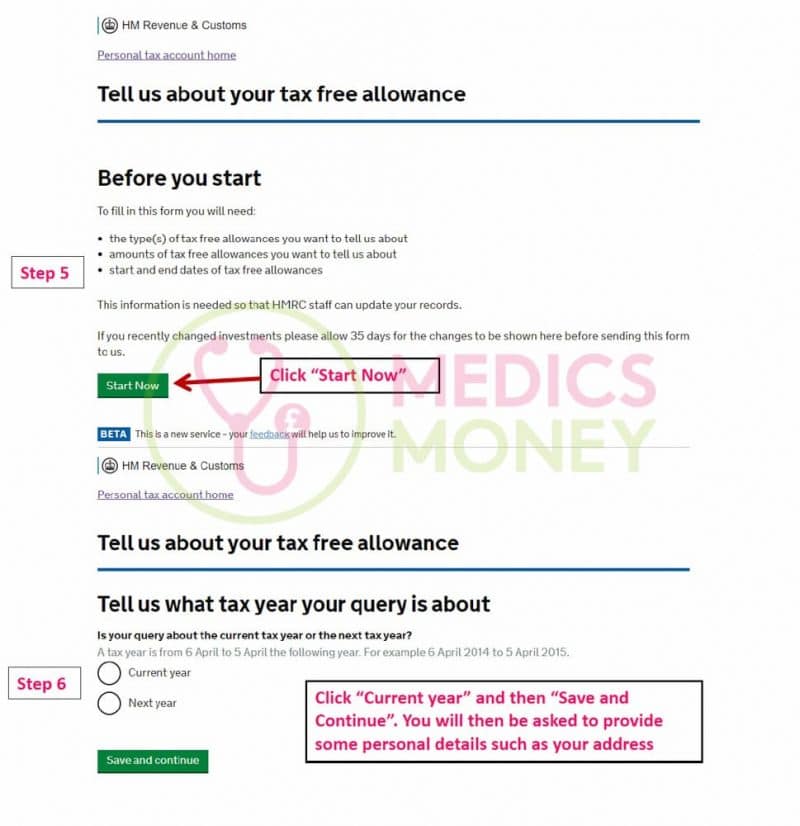

To start, log onto your Personal Tax Account then follow the steps below.

Once you have filled in this box, you have the option to make other changes e.g. if you have more incorrect tax allowances you want to change. Once you are finished, the request will be sent to HMRC who will then consider the request and, if they agree, liaise with your Payroll Department to get your tax code changed.

Join 30,000 doctors and receive free, exclusive, financial CPD for doctors in your inbox.

Medics’ Money is run by doctors and finance experts, for doctors. Our free financial CPD gives you all the knowledge you need to take control of your finances.