How to invest through a limited company

Do you or your partner run a limited company, receive income and dividends (up to a tax-efficient threshold) and then leave any surplus profits in your account? Have you considered that if your money does is sit in an account doing nothing, over the years the money will actually lose value due to inflation.

You can combat losing money with a well thought out investment strategy. If you invest it, at least you have the chance of earning interest as opposed to losing it while it is sat untouched in your account.

Read on to find out how to invest your limited company profits and grow your wealth.

What could happen if you leave your profits in your bank account.

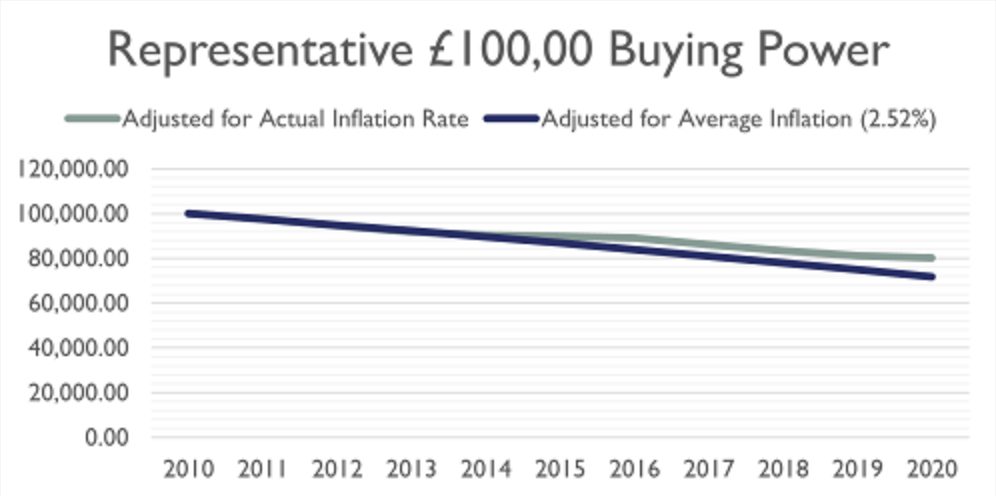

Inflation rates sourced 11/06/2021

If you just let that £100,000 sit over the time period, taking into account the UK inflation rate, your original buying power would be worth less. £100,000 becomes £80,232 of buying power. Potentially that’s nearly £20,000 of lost revenue.

Investing through a limited company

If you ever wanted to take that money out, you would be subject to 32.5%/38% dividend tax upfront. Now, with that money freed up you can put it into ISAs and other allowances, but if you invested through the company and access it as little as possible it could be much more profitable, long-term.

Example

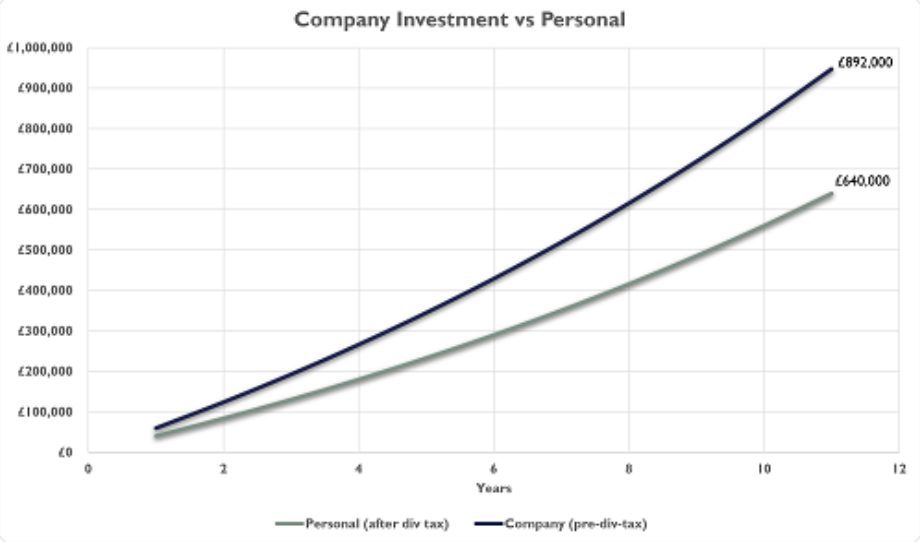

Let’s say your cash profit is £60k each year. If you invest this, assuming an average 7% annual return and 19% corporate tax, after 10 years, that could potentially equal £892,000.

If you took your £60k and instead invested personally, you could end up with £640,000 over the 10 years, which is £252,000 less.

If you decide to take that money out of the business after the 10 years, even minus relevant taxes, this could be a much more profitable long term strategy.

The two ways you can invest through your limited company:

- The first option is a holding company that owns your trading company and receives the cash surplus as dividends.

- The second option is opening a totally separate company and receiving money as a loan from your trading company.

The second option is favoured by tax advisers who agree that having two companies as separate entities is a clearer structure and easier to set up and you could also qualify for Entrepreneur’s Relief if the loan is repaid in full. Which means if you should plan to close down or sell your business, you’ll only need to pay 10% capital gains tax on the gains.

But everyone’s situation is different, so be sure to discuss your personal or company investments with your trusted financial adviser before making any decisions.

Where to invest your funds

Your company investment plan should follow the same strategy as your personal wealth plan – with a diversified portfolio. Having diversified investments means if you take a hit in one area, you’re covered in all the others.

Where you invest will probably depend on a number of factors. You might want an investment platform so you can easily track your investments and tax liabilities. Or maybe where you want to be in 5 to 10 years and your other long-term savings and investments plans are more important in choosing the best mix for you.

Work with a professional

There’s no way around it, no matter how you invest through your limited company, you will have to deal with taxes.

At Dental & Medical Financial Services our passion is helping you save you to make tax efficient choice. and including your tax affairs in your overall financial strategy. Reach out to us today if you want to ensure your wealth grows and is protected for years to come.

Dental and Medical Financial Services is an appointed representative of Best Practice IFA

Group Limited, which is authorised and regulated by the Financial Conduct Authority.

This does not constitute advice and advice should be sought in all instances before acting on it. An investment may go down in value as well as up, you may not get back the full amount invested.