When did you last scan through your own bank account with as much diligence as you scan your patients’ test results?

Do you know what your monthly outgoings are? How much do you spend per month on non-essentials, like that cup of coffee at the station each day. All the time you have debt you need to try and continue spending like a student – frugally. Even if you don’t have any debt, it’s still important to set a budget and not waste your hard-earned money.

When I was an FY2, I used to frame any planned expenditure in

“number of post-take ward rounds needed to earn money to buy …..“

More recently, I’ve framed it as number of hours spent preparing for CQC inspections.

When you frame costs in these terms, I guarantee you will save money!

Sit down with last few month’s bank statements and carefully go through your expenditure. Do you really need those monthly subscriptions? Could you spend less and still enjoy life? How many times did you buy lunch in the last month? A packed lunch is always cheaper and often better than hospital food. The greater your debt or savings goals, the more scrupulous you will need to be. Budgeting is a prospective exercise, so once you’ve analysed your spending retrospectively, set a realistic prospective budget.

Dr Sophie’s hospital lunch bill of £139,680?

If you need motivation for how small amounts of unnecessary spending add up then compound interest is it. Einstein reportedly described compound interest as

“the 8th wonder of the world”

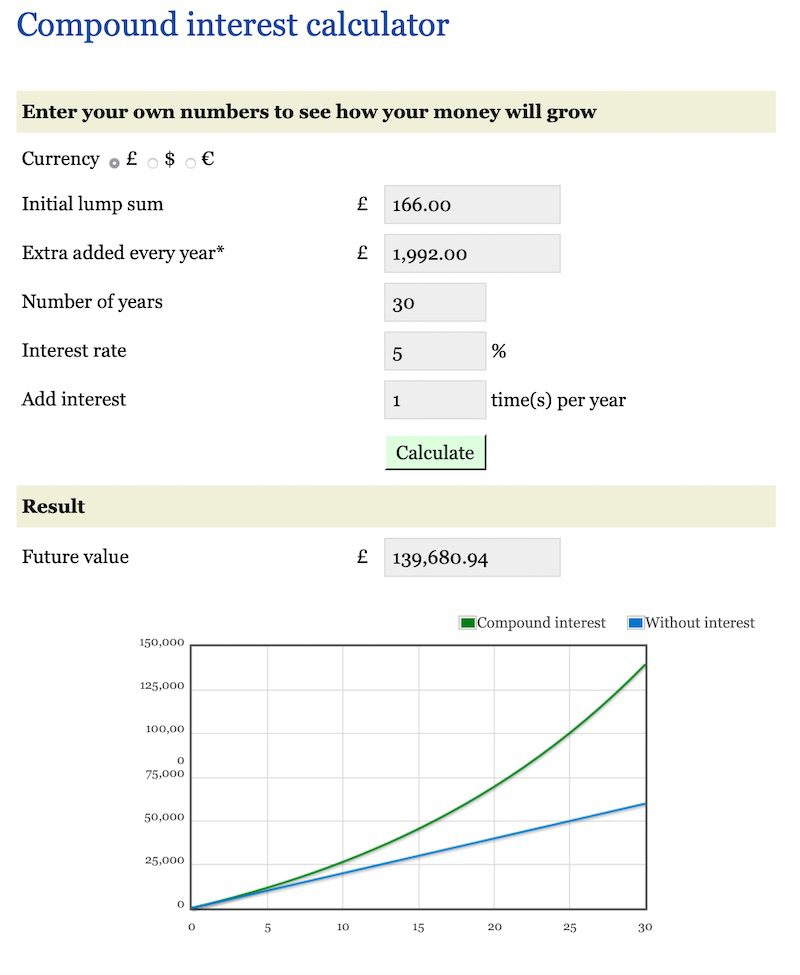

and its certainly the first wonder of the financial world. Let’s use the example of Sophie, an ST7 in Cardiology who discovered Medics’ Money site a year ago and used our resources to transform her financial future. Sophie was busy preparing to CCT, finishing her PHD and job hunting, so she didn’t have time to make a packed lunch. Soon she realized she was spending £200 per month in the hospital canteen. She committed to making a packed lunch and trimmed her spend by £166 per month. If Sophie re-invested that money for the rest of her 30-year career as a doctor how much would she have saved?

£59,760 right? (£166 multiplied by 12months multiplied by 30 years)

WRONG

It’s likely to be £139,680. This assumes an average return of 5% on the income being invested, which historically is possible with a long-term well-balanced portfolio.

I don’t like to say never, but I will say I will NEVER have a hospital lunch that was worth £139,680! If you need motivation that small cuts in your spending, get big results if managed well, then have a play around with the various compound interest calculators available online.

From https://monevator.com/compound-interest-calculator/

Rule of 72

If you don’t happen to have a compound interest calculator handy, but do want to ROUGHLY calculate expected returns, then the rule of 72 is for you. The rule of 72 is a useful way to calculate how long the value of any investment will take to double. You simply divide 72 by the annual rate of return and approximately tells you the time for that investment to double. So, if you invest £1000 at an interest rate of 5% it would take roughly 14.4 years to make £2000.

Don’t waste money on household bills

Minimising unnecessary expenditure generates cashflow to facilitate reducing debt (see below) or to grow as investments. You can take this minimising of expenditure as far as you like, it’s a personal decision. I’m not going to list all the ways you can trim your excess spending, but think about big wins first like minimising household bills, regularly reviewing your mortgage deal and insurance, avoiding high transport costs and expensive car leases; the list is almost endless.

Again, write it down so you can track it and spot any anomalies. When I started in 2008 spreadsheet was the only option and that’s what I continue to use. But now there are many online dashboards to help you like https://www.moneydashboard.com Recently my bank has released software that can help to track your spending and your bank may have similar.

On our family spreadsheet we split household bills down by essential spending like utility bills etc and non-essential spending, like holidays, bikes and surfboards. A good reason to do your fPDP together as whilst I consider surfboards and bikes essential spending, my wife does not! We always focus on minimising essential spending very thoroughly. Review your utility bills annually and shop around for the best price. Your boiler doesn’t know if it’s being fed expensive gas or the cheapest gas on the market – it all burns the same. Even bills that seem non-negotiable may not be so. A Medics’ Money reader emailed me to say he’d saved several thousand by renegotiating the banding of his house for his council tax bill.

Get paid to spend money

Get creative. I personally use cashback or reward credit or debit cards for all spending, which I repay in full each month. Consulting my latest statements, this strategy earned me nearly £800 last year. This feels particularly sweet, because for too many years, I was forced to use credit cards and accrue expensive debt, which is the worst kind of debt to carry.

Pay yourself first to ease the pain

If your fPDP and analyzing your outgoings identify you need to make some savings, paying yourself first is a great way to do it. Personally, I don’t do well with ultra-restrictive budgeting. Like crash diets, it just doesn’t work for me. I feel trapped and guilty for any money that I do spend and it makes me miserable. But paying yourself first does work well for me. Paying yourself first means, each month before you even touch your wages, pay out the savings amount you committed to in your fPDP first. Put this money in a separate account and do this automatically each month. Then the rest of what you have left after paying bills etc is your money to enjoy and you can spend it guilt free. By making automatic payments every month, as specified in your financial PDP you will hit your SMART goals automatically and automatic saving and automatic making money is good.

The NHS Pension is still a great deal for the vast majority

Paying yourself first before income is taxed is one of the best ways and this is what the NHS pension does for you. Each month a % of your pre-tax income is paid into your pension by you and topped up by your employer. This is incredibly tax efficient way to save for your future. In week five I will detail the essential NHS pension check all doctors need to make.

Debts

Unless you were lucky enough to have financial support at medical school, you likely have thousands of pounds of debt. I personally graduated with over £85,000 of debt.

It is important to analyse any debt carefully and identify the most expensive (bad debt) – like credit cards. Repay these first. If you have lots of bad debt on credit cards, consider whether consolidating this debt using an interest free credit card or cheaper loan could help. When I had a student loan (2008), the interest rate was very favourable (good debt). With helpful advice, I calculated that I could make more by investing money and therefore reduced my student loan debt relatively slowly, as a deliberate strategy.

Should I repay my student loan early?

Recently student loans have changed and the terms are not as favourable for those that will eventually earn a decent salary like doctors. Careful consideration of managing this student loan debt is required. Beware a lot of online gurus and guides advocating paying off student loan slowly, based on the assumption you will never earn enough to repay the loan in full. This may be true for those on average graduate salaries, but as a doctor, eventually you will be on a much higher salary than average and you need to do your own calculations as part of your fPDP. Unlike other debts, if you can’t work, your student loan payments pause which is useful.

Week 3 – Action points

Another massive week this week. But compared to finals or postgraduate exams or any of the other complex things we as doctors do on an almost daily basis, its easy. But you do have to do it. So this week’s goals are,

1 – Document and analyse your spending and identify where any savings can be made.

2 – Analyse your debts and get a plan to pay them down, starting with the debt with the highest interest rate.

Halfway day

Back in 2013 my wife and I decided to take a 3-month sabbatical, part of which we spent driving a bright orange converted fire truck with no aircon 4000 kilometres across the outback, from Sydney to Perth. The journey is best described as character building. Some of you may be feeling like this reading “What medical school didn’t teach us”

Well we are halfway, and it’s downhill from here. On the horizon is how to protect your future income, essential checks every doctor needs to make on their NHS pension and how to make money by investing. Let’s hope we don’t run into a locust storm that blocked our radiator and nearly cooked our engine thousands of miles from civilisation in the outback.