By Dr Tommy Perkins, NHS GP and Medics’ Money founder.

So, you’ve been a doctor a few years, earn a decent wage, but still your bank account is empty at the end of the month? Do you struggle to pay those expensive post graduate exam courses and fees? Perhaps you are trying to save for a wedding, mortgage or school fees. Or maybe you’ve been a doctor for many years and have minimal savings and few assets. You might even have been hit by a tax bill you couldn’t pay and didn’t really understand.

You are not alone.

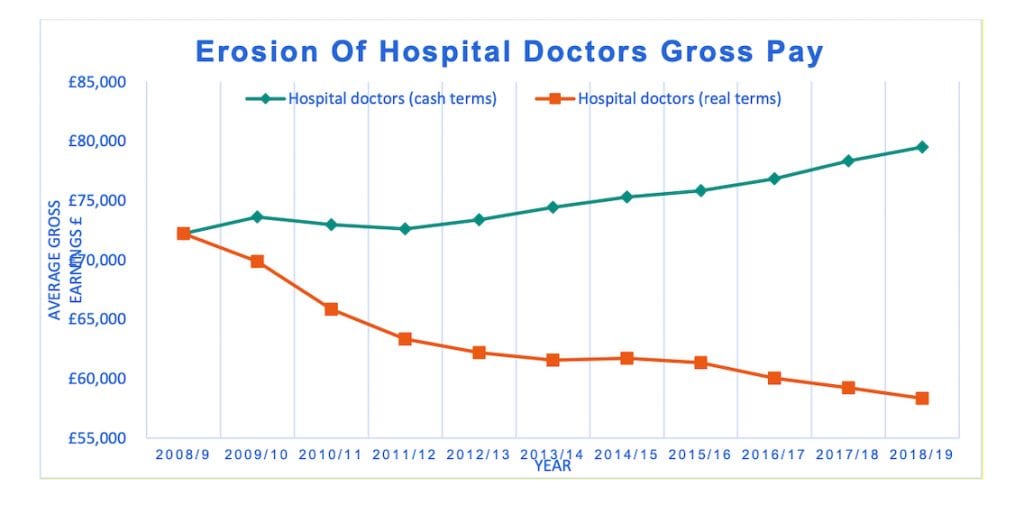

The downward spiral of doctors pay

Over the last 10 years some doctors pay has dropped 30% in real terms, according to the BMA 1. If, like me you live in an area with a high cost of living, like London or the southeast, it’s likely the problem is even worse. Add in the rising cost of medical school and the increasing pension contributions with punitive taxation it’s clear that now, more than ever, doctors of all ages need to be financially astute.

From BMA https://www.bma.org.uk/media/2123/bma-ddrb-submission-2020.pdf

Real terms pay cuts for doctors is only half the story.

The other half of the story is what medical school didn’t teach you or me about money. As doctors we receive plenty of medical education, but almost no financial education. Unfortunately, this trend continues throughout our careers. What little financial CPD we do receive, often comes from poorly qualified salespeople who put their own interests above yours.

With all of this against us, it’s no wonder we can struggle with our finances. Mastering our finances is not difficult. Doctors are intelligent people and if you empower yourself with the right information you can take control your financial future. Once you do that, you can become financially independent – no longer reliant on working 70-hour weeks or doing locum shifts to make ends meet. Financial independence will give you the choice to work when and how you want and in my personal experience, that has made me a better doctor.

Over the next few pages, I will show you how Medics’ Money can give you the financial CPD you need and help you fight back against this downward spiral of doctors pay and to improve your own financial health.

This will include how to,

- Develop your SMART ‘Financial Personal Development Plan’ (fPDP)

- Maximise income

- Minimise unnecessary expenditure

- Build a moat to protect you and your family

- Repay your debts

- Grow your wealth

- Get good advice

Firstly, well-done for finding Medics’ Money and subscribing to this email. You’ve taken the first step to financial freedom and by completing the action steps at the end of each week you will begin the path to financial freedom.

My journey to financial enlightenment

I was the first of my family to attend university and I had crippling debts of around £85,000 when I graduated as a doctor in 2008. This forced me to learn how to manage my finances. Like many of you, I’d never received any formal financial training. I was however subjected to “free” lunchtime talks from barely qualified salespeople, looking to exploit my financial naivety and potential earning capacity. I realised pretty quickly I needed a financial personal development plan (fPDP). 12 years later, I’m now debt free (except for mortgages) and have started to build up some assets and investments for my young family, crucially whilst also maintaining a work life balance. If you managed not to accrue debt at medical school, well done, you are ahead of many of your peers. But you need to capitalise on this position. Over the next few pages, I’m going to help you learn what medical school didn’t teach us about money. If like me it’s a while since you left medical school, this information is even more relevant to you as, you have less time until retirement and less time to recover from any mistakes. Here at Medics’ Money we practice Primary, Secondary and Tertiary prevention for doctors’ financial health. So, if like me, you already have a few financial scars, don’t worry, we can help you.

Let’s take this step by step. First up, like your appraisal, let’s start by developing your financial Personal Development Plan (fPDP).

As doctors we are about as goal driven as it gets and we’re also incredibly good at achieving these goals. But when did you last set a financial goal? What are your financial priorities for the next 5 years? Longer term, do you want to work to state retirement age – currently 68 for me. Or do you want to achieve financial independence so you can choose when and how you work? I’m only 38, but I know right now, I do not want to work full time to 68 years of age and a good chunk of my personal fPDP is geared to making that possible.

I bet you have a PDP as part of your appraisal, but what’s your financial PDP (fPDP)?

Everyone’s fPDP goals will be unique to them. It can be as simple as paying off credit cards, start investing, saving for a house deposit, investing in training to improve your income or send your children to a private school. I like to break goals down into short, medium, and long-term goals. Specific, Measurable Attainable, Relevant, Time bound (SMART) goals are useful, but you already knew that thanks to the joy of appraisal.

Your fPDP will contain many goals. For example,

S – Save £10,000 for a house deposit.

M – If I save 20% of my income each month, I will have £10,000 in two years.

A – My income as Dr is stable and saving the £10,000 doesn’t rely on unreliable events like locum work or winning at blackjack. I have setup a separate savings account and a monthly transfer to ensure I save the money not spend it. (an example of pay yourself first, more detail below)

R – Although ambitious to save 20% I have analysed my spending, made some savings for example by not wasting £7 buying lunch every day.

T – I will review progress monthly to check I’m reaching my target of 2 years to save £10,000

Whatever you do, write it down. We have our family fPDP in a word document along with a spreadsheet that we use to track our expenses, investments and other financials.

If you have a partner, or like me a family, then this planning should be done together for many reasons.

Reasons to fPDP as a family

- Engagement – if everyone’s contributed to the plan and agrees the goals contained in it then everyone’s engaged.

- Tax – if you have a partner or family you may be able to spread the tax burden out across the family using various allowances and reliefs.

- Strengthens relationships – if tough financial decisions need to be made, then making them together rather than forcing them upon the rest of the family is best.

- Educating your children – the sooner your children learn the basics of money management, the sooner they can be financially free. You can be their financial role model.

- Reforming a high spending spouse – in any relationship, its likely one of you will be more frugal and this can lead to conflict. My wife is more frugal than me and doing our fPDP together helps to temper my occasionally impulsive desires for new surfboards or bikes.

Calculate your net worth.

Calculating your net worth is an essential part of your fPDP and one of the benchmarks you will use over time to measure its success is your net worth. Your net worth is simply

£Net worth = total assets – total liabilities

Your assets may include things like equity in any property, cash, investments and pensions.

Liabilities are debts. Try not to get bogged down in the details of what should and shouldn’t be included. As long as you keep what you include in the calculation consistent year to year then you will have a method of tracking your success.

At least annually, recalculate to track your progress. Is your net worth a positive number? Well done, you are ahead of where I was at the start of my career! But if you want financial freedom you are going to need a VERY positive net worth to facilitate that.

How will you attain your goals?

If you’ve simply put “save up money” that is unlikely to be successful. Like patients whose plan is “just stop smoking” you know it’s unlikely to work. You need a specific, detailed, well thought out plan on how you will achieve your financial goals.

I’ve found the help of a qualified Independent Financial Adviser (an IFA) invaluable here as they can delve deep into your finances and help you make a realistic, attainable plan.

Each week we will set some goals to keep you on track. Simply reading this document is not enough, you need to act on the information it contains to secure your financial future.

Week one goals.

Step 1 – Calculate your net worth

Step 2 – Develop your fPDP goals. Do this with your partner or family if applicable.

Step 3 – Have a think about your long-term goals

Do all the goals on your fPDP involve more money? Now, you could simply work harder to get more money. Or you could maximise the income you already have, without doing more work.

And that’s what we will look at next, maximising income.

Chapter 2

Last week we introduced the concept of a financial plan, calculating net worth and you should have written down some goals and made an fPDP.

Avoid making charitable donations to HMRC

Do all the goals on your fPDP involve more money? Now, you could simply work harder to get more money. Or you could maximise the income you already have, without doing more work. Skeptical? Read on to find out about tax reliefs for doctor’s worth £thousands.

What will be your greatest single expenditure in life? Mortgage? Household bills? Transport costs? Holidays? No, it’s likely your biggest expense will be the total taxes you pay to the government. Therefore, it makes sense to make very sure you are paying only the tax you need to.

Sounds simple right? In reality, this is very complex to do well and the more senior you get, with multiple income streams and multiple tax thresholds and reliefs to think about, the more complex it gets. At that point, you could benefit from professional advice from a specialist medical accountant. Until then here’s some things to think about.

1 – Claim a tax rebate.

Estimated saving minimum £2,262

Claiming a doctors’ tax rebate can reduce the costs doctors have to pay on tax deductible expenses such as exams, GMC fees, Royal College fees etc by up to 40%. For example, a GP trainee would expect to incur Professional Fees of around £5,656 in the 5 years from FY1 to their final year which could save them £2,262 in tax – and that assumes they pass all their exams first time. The longer the training, and the higher the total exam costs the more tax relief you will be eligible for.

We have produced free step by step guides to claiming tax relief for doctors which you can download here.

https://www.medicsmoney.co.uk/free-guide/

Not sure if it’s worth claiming? It absolutely is, but you can run a quick crude calculation here

https://www.medicsmoney.co.uk/doctors-tax-rebate-calculator/

2 – Check your tax code.

Estimated saving £varies

A big problem for doctors is tax code errors. As we switch jobs in, say, August we will usually receive a payslip from our old employer and our new employer, confusing HMRC into thinking that we are working 2 jobs and applying the wrong tax code. Luckily we’ve made a free step by step guide to sorting out your tax code.

Here’s our guide to checking your tax code is correct.

https://www.medicsmoney.co.uk/is-your-doctors-tax-code-correct/

3- Claim travel and relocation expenses.

Value up to £8,000 over course of training

You may be able to claim up to £8,000 tax free relocation expenses during training. This can include paying your stamp duty, removal fees, legal fees and can include travelling expenses between hospitals. Further information can be found here https://heeoe.hee.nhs.uk/faculty-educators/policy-reimbursement-removal-or-rotational-travel-expenses

If you are a GP trainee on GP placement you can also claim mileage to and from work in certain circumstances. This explains more https://www.bma.org.uk/advice/employment/gp-practices/gps-and-staff/reminbursement-of-gp-trainee-travel-expenses-for-your-practice

More information about mileage claims here

https://www.medicsmoney.co.uk/doctors-tax-relief-on-mileage-and-travelling-for-work-using-own-car/

4- Got children? You could claim child benefit.

Estimated value annually £1,076 one child £712 for each additional child

You can claim child benefit for each child you’re responsible for. If your income exceeds £50,000 per year you’ll receive a reduced amount and need to complete Self-assessment and if your income exceeds £60,000 you will need to tell HMRC immediately. Somewhat bizarrely, if one parent earns £61,000 per year and the other earns nothing (total household income £61,000) you can’t claim but if both parents earn £49,999 or less (total household income £99,998) you can claim the full amount. The whole claiming process can be completed online. Details how to claim here

https://www.gov.uk/child-benefit

5- Tax free childcare

Estimate value – Tax free childcare £2,000 per child per annum. 30 free hours a week £2400* estimate based on 570 hours a year.

https://www.childcarechoices.gov.uk

You can get Tax-Free Childcare at the same time as 30 hours free childcare if you’re eligible for both. Be aware if your income goes over £100,000 p.a. you will no longer be able to claim.

6 – If doing extra/private work think about tax efficient remuneration structures.

This is NOT as straightforward as simply starting a Ltd company to “save tax” https://www.medicsmoney.co.uk/limited-company-for-gp-locum-doctors-and-consultants/

7 – Is your contract and pay correct?

If you’re a member, the BMAs contract checking service may be useful.

8- Understand your payslip.

Your payslip is like the anatomy and physiology of your finances. Understanding it is essential you getting control of your finances. Here’s an overview of a doctors payslip.

https://www.medicsmoney.co.uk/doctors-pay-slip/

By now you should have thought about your financial PDP (fPDP) and how to work tax efficiently. If you are at the start of your career, with the resources I linked to above, you can make yourself tax efficient. If you are more senior ST5 or above, or earning six-figure income, with multiple income streams and still doing your own self-assessment; STOP. Get yourself a specialist medical accountant – or at least consider it. It’s very likely they will save you more than they cost you. There’s too many mediocre accountants out there and that was why we created Medics’ Money. We have gathered together the best specialist medical accountants, verified by us with reviews by doctors like you. Best of all, you can book a free consultation with one right now.

https://www.medicsmoney.co.uk/medical-accountant-search/

Week 2 goals

1 – Use Medics’ Money free resources to make sure your tax code and tax reliefs are correct.

2 – Think about other ways you can become tax efficient such as child benefits and tax free childcare.

3 – Check your contracts and pay banding are correct.

Chapter 3

When did you last scan through your own bank account with as much diligence as you scan your patients’ test results?

Do you know what your monthly outgoings are? How much do you spend per month on non-essentials, like that cup of coffee at the station each day. All the time you have debt you need to try and continue spending like a student – frugally. Even if you don’t have any debt, it’s still important to set a budget and not waste your hard-earned money.

When I was an FY2, I used to frame any planned expenditure in

“number of post-take ward rounds needed to earn money to buy …..“

More recently, I’ve framed it as number of hours spent preparing for CQC inspections.

When you frame costs in these terms, I guarantee you will save money!

Sit down with last few month’s bank statements and carefully go through your expenditure. Do you really need those monthly subscriptions? Could you spend less and still enjoy life? How many times did you buy lunch in the last month? A packed lunch is always cheaper and often better than hospital food. The greater your debt or savings goals, the more scrupulous you will need to be. Budgeting is a prospective exercise, so once you’ve analysed your spending retrospectively, set a realistic prospective budget.

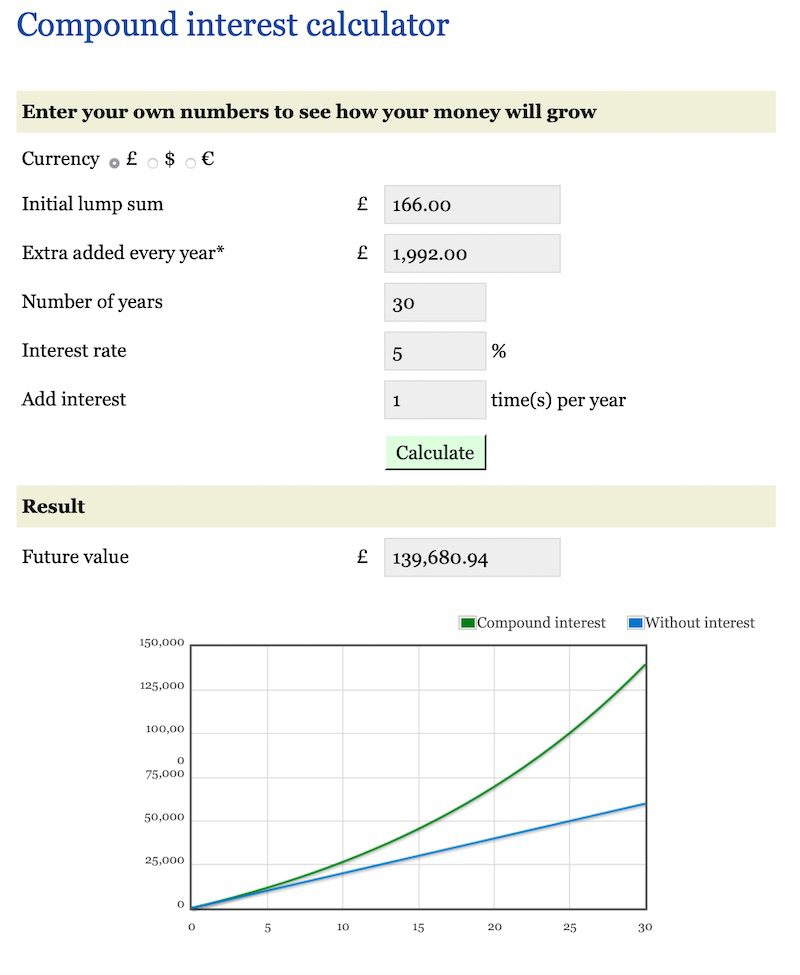

Dr Sophie’s hospital lunch bill of £139,680?

If you need motivation for how small amounts of unnecessary spending add up then compound interest is it. Einstein reportedly described compound interest as

“the 8th wonder of the world”

and its certainly the first wonder of the financial world. Let’s use the example of Sophie, an ST7 in Cardiology who discovered Medics’ Money site a year ago and used our resources to transform her financial future. Sophie was busy preparing to CCT, finishing her PHD and job hunting, so she didn’t have time to make a packed lunch. Soon she realized she was spending £200 per month in the hospital canteen. She committed to making a packed lunch and trimmed her spend by £166 per month. If Sophie re-invested that money for the rest of her 30-year career as a doctor how much would she have saved?

£59,760 right? (£166 multiplied by 12months multiplied by 30 years)

WRONG

It’s likely to be £139,680. This assumes an average return of 5% on the income being invested, which historically is possible with a long-term well-balanced portfolio.

I don’t like to say never, but I will say I will NEVER have a hospital lunch that was worth £139,680! If you need motivation that small cuts in your spending, get big results if managed well, then have a play around with the various compound interest calculators available online.

From https://monevator.com/compound-interest-calculator/

Don’t waste money on household bills

Minimising unnecessary expenditure generates cashflow to facilitate reducing debt (see below) or to grow as investments. You can take this minimising of expenditure as far as you like, it’s a personal decision. I’m not going to list all the ways you can trim your excess spending, but think about big wins first like minimising household bills, regularly reviewing your mortgage deal and insurance, avoiding high transport costs and expensive car leases; the list is almost endless.

Again, write it down so you can track it and spot any anomalies. When I started in 2008 spreadsheet was the only option and that’s what I continue to use. But now there are many online dashboards to help you like https://www.moneydashboard.com Recently my bank has released software that can help to track your spending and your bank may have similar.

On our family spreadsheet we split household bills down by essential spending like utility bills etc and non-essential spending, like holidays, bikes and surfboards. A good reason to do your fPDP together as whilst I consider surfboards and bikes essential spending, my wife does not! We always focus on minimising essential spending very thoroughly. Review your utility bills annually and shop around for the best price. Your boiler doesn’t know if it’s being fed expensive gas or the cheapest gas on the market – it all burns the same. Even bills that seem non-negotiable may not be so. A Medics’ Money reader emailed me to say he’d saved several thousand by renegotiating the banding of his house for his council tax bill.

Get paid to spend money

Get creative. I personally use cashback or reward credit or debit cards for all spending, which I repay in full each month. Consulting my latest statements, this strategy earned me nearly £800 last year. This feels particularly sweet, because for too many years, I was forced to use credit cards and accrue expensive debt, which is the worst kind of debt to carry.

Pay yourself first to ease the pain

If your fPDP and analyzing your outgoings identify you need to make some savings, paying yourself first is a great way to do it. Personally, I don’t do well with ultra-restrictive budgeting. Like crash diets, it just doesn’t work for me. I feel trapped and guilty for any money that I do spend and it makes me miserable. But paying yourself first does work well for me. Paying yourself first means, each month before you even touch your wages, pay out the savings amount you committed to in your fPDP first. Put this money in a separate account and do this automatically each month. Then the rest of what you have left after paying bills etc is your money to enjoy and you can spend it guilt free. By making automatic payments every month, as specified in your financial PDP you will hit your SMART goals automatically and automatic saving and automatic making money is good.

The NHS Pension is still a great deal for the vast majority

Paying yourself first before income is taxed is one of the best ways and this is what the NHS pension does for you. Each month a % of your pre-tax income is paid into your pension by you and topped up by your employer. This is incredibly tax efficient way to save for your future. In week five I will detail the essential NHS pension check all doctors need to make.

Debts

Unless you were lucky enough to have financial support at medical school, you likely have thousands of pounds of debt. I personally graduated with over £85,000 of debt.

It is important to analyse any debt carefully and identify the most expensive (bad debt) – like credit cards. Repay these first. If you have lots of bad debt on credit cards, consider whether consolidating this debt using an interest free credit card or cheaper loan could help. When I had a student loan (2008), the interest rate was very favourable (good debt). With helpful advice, I calculated that I could make more by investing money and therefore reduced my student loan debt relatively slowly, as a deliberate strategy.

Should I repay my student loan early?

Recently student loans have changed and the terms are not as favourable for those that will eventually earn a decent salary like doctors. Careful consideration of managing this student loan debt is required. Beware a lot of online gurus and guides advocating paying off student loan slowly, based on the assumption you will never earn enough to repay the loan in full. This may be true for those on average graduate salaries, but as a doctor, eventually you will be on a much higher salary than average and you need to do your own calculations as part of your fPDP. Unlike other debts, if you can’t work, your student loan payments pause which is useful.

Week 3 – Action points

Another massive week this week. But compared to finals or postgraduate exams or any of the other complex things we as doctors do on an almost daily basis, its easy. But you do have to do it. So this week’s goals are,

1 – Document and analyse your spending and identify where any savings can be made.

2 – Analyse your debts and get a plan to pay them down, starting with the debt with the highest interest rate.

Halfway day

Back in 2013 my wife and I decided to take a 3-month sabbatical, part of which we spent driving a bright orange converted fire truck with no aircon 4000 kilometres across the outback, from Sydney to Perth. The journey is best described as character building. Some of you may be feeling like this reading “What medical school didn’t teach us”

Well we are halfway, and it’s downhill from here. On the horizon is how to protect your future income, essential checks every doctor needs to make on their NHS pension and how to make money by investing. Let’s hope we don’t run into a locust storm that blocked our radiator and nearly cooked our engine thousands of miles from civilisation in the outback.

Chapter 4

I don’t insure anything I can afford to replace like my phone, washing machine or even my beloved bikes. But I do insure the future of my family and myself – and unless you could afford your current lifestyle without your income then you need to insure your financial future.

Dragging myself up from a net worth of at least MINUS £85,000 when I graduated, to where I am now has been a hard journey of personal financial education for me. I’ve made many mistakes along the way. One of my biggest mistakes was not taking out income protection and life insurance sooner. I got lucky, but unfortunately, at Medics’ Money we are regularly contacted by doctors who have left protection too late and sadly got ill and either can’t get insurance, or the insurance is unaffordable. Read that again slowly, repeat it and then read Week 4 of:

“What medical school didn’t teach us about money.”

Every doctor needs an emergency fund

In the same way that a moat surrounds and protects a castle from attack, your finances need a moat. Most experts recommend having at least 3 months emergency funds – the cost of essential outgoings, saved up in cash to use in event of trouble. When I was a self-employed locum, with a young family, I had 6 months saved up. Once I secure permanent employment, I reduced this back to 3 months by spending the difference on a 2 month windsurf trip to Hawaii. Great memories, but a slightly difficult conversation with my financial adviser at our annual review and yes I ran the compound interest calculations on what that holiday would have earned us in 30 years, but YOLO right?

Inflation proofing your emergency fund

With interest rates for savers pitiful at present, it’s hard to store wealth as cash without its value effectively going down due to inflation. The gambler in me enjoys the mediocre returns offered by premium bonds and offset mortgages may be another option to store you cash emergency fund. Wherever you store it, the emergency cash just needs to be instantly accessible and you need to carefully calculate or take independent financial advice on the best option for you.

If the moat is your emergency cash fund, then insuring against illness or disability is the foundations of the castle itself. A moat will protect you for a short period but an often overlooked, absolutely fundamental, part of protecting your finances is to insure yourself against illness or disability.

You have worked hard to become a doctor and that is an asset that you need to protect.

After too many years without, read why a surf trip to one of the world’s most dangerous waves prompted me to take out protection.

https://www.medicsmoney.co.uk/income-protection-tom/

How much risk are you at?

This can help you run some calculations

If you’ve got protection already, well done, but did you get a good deal or did a salesperson sell you a policy that paid them the most commission? Read here to see how using a Medics’ Money Independent adviser saved two doctors over £10,000.

https://www.medicsmoney.co.uk/income-protection-for-doctors-getting-the-best-deal/

Our blog has a dedicated section on protection and I suggest you read it now.

https://www.medicsmoney.co.uk/medical-accounting-blog/?catname=protection

If you’ve left the NHS pension scheme, or are a locum Dr, you have likely given up valuable protection benefits. Have you consulted a suitably qualified financial adviser about replacing these benefits? If not, do it now. Its free to have a consultation with a Medics’ Money approved Independent Financial Adviser here.

https://www.medicsmoney.co.uk/find-a-specialist-medical-ifa/

If you don’t understand the difference between restricted and independent financial advice and want to know why Medics’ Money ONLY recommends independent advice read this.

https://www.medicsmoney.co.uk/independant-financial-advisers-ifa-for-doctors/

I already mentioned that taking out protection too late may have been my biggest financial mistake so far. I’ve thought about why I didn’t take out protection sooner. For me it boiled down to 3 things

- I felt invincible when I was young, I’m not sure why. As soon as I had kids I took out protection. But this could easily have been too late.

- I didn’t know where to get the right cover for the right price and I was suspicious of the salespeople who targeted my naivety at medical school and “free” lunchtime talks. This led to me being suspicious of all financial advisers. This was a mistake as there are many excellent advisers out there and we’ve gathered together the best on Medics’ Money.

- I’m frugal and like to minimize unnecessary expenses. Minimising my expenses by not protecting my income was a step too far and I’m so glad I finally listened to my Medics’ Money approved Independent Financial adviser and got protection.

Chapter 4 action points

Don’t be tempted to skip reading any of the links this week – it’s the biggest week of all. Not only do you need to think about protecting your financial future, you also need to understand how the financial services industry works. Until you understand how the industry works, you won’t be able to spot the salespeople from the good advisers. Good independent advisers like those featured on Medics’ Money can significantly enhance your wealth for a fair price. A big part of why we started Medics’ Money was to provide a directory of the “good guys” Independent financial advisers that have satisfied our rigorous criteria. Also be aware, that we reject the majority of advisers that approach us and ask to join our network. What really scares me, is that some of these advisers we reject are advising many doctors or have been recommended to us in good faith by other doctors.

Its free to get an assessment from a Medics’ Money verified financial adviser and you can book a consultation right here

https://www.medicsmoney.co.uk/find-a-specialist-medical-ifa/

We believe in absolute transparency and from day one our website has included the following text,

How is Medics’ Money funded?

Medics’ Money started because we wanted to help our friends and colleagues make better financial decisions. That ethos is the driving force behind Medics’ Money today. Our website is free for doctors to use. We charge accountants and advisers a small fee to appear on our site and for receiving enquiries, ONLY if they pass our rigorous verification process which is outlined here https://www.medicsmoney.co.uk/medics-money-approved/

Ed and Tommy both work as Doctors in the NHS and all profits are re-invested into improving the range of services we offer to doctors.

If someone else makes a recommendation of where to get advice, ask them what their conflict of interest is and what due diligence they have done. You may be unpleasantly surprised. If they won’t answer, proceed with caution.

Chapter 5

Investment for doctors

So you’ve traipsed through the Tax week, where we stopped ourselves making unnecessary charitable donations to the tax man. You’ve battled through the budgeting section, which although boring, hopefully you identified some savings. You’ve also insured your future income by taking out some appropriate insurance and got an emergency cash fund saved up. If you haven’t done all that then stop, go back and do it now. It’s important to have the basics covered before moving onto more complex subjects like investing.

Next up it’s investing. Now I’m not going to tell you about a how to make a million pounds trading shares and retire by Friday. If you’re expecting me to give you get rich quick schemes or tips on individual shares to invest in, you’re going to be disappointed. If getting rich quick is very hard, the good news is getting wealthy slowly is not particularly hard, but it takes commitment, discipline, knowledge and probably advice.

Why invest?

This is personal to you and your fPDP. Maybe you’re saving up to send the children to private school or for a house. Perhaps like me you want the financial freedom to choose when and where you work. Unless you want to earn every penny of your wealth at the coalface being a doctor until you reach retirement, you need an alternative income and investing could be it.

It’s important to consider timeframes here. Anything less than 5 years is a very short time frame for investing and as we’ll see later, the longer you invest for the less the risk.

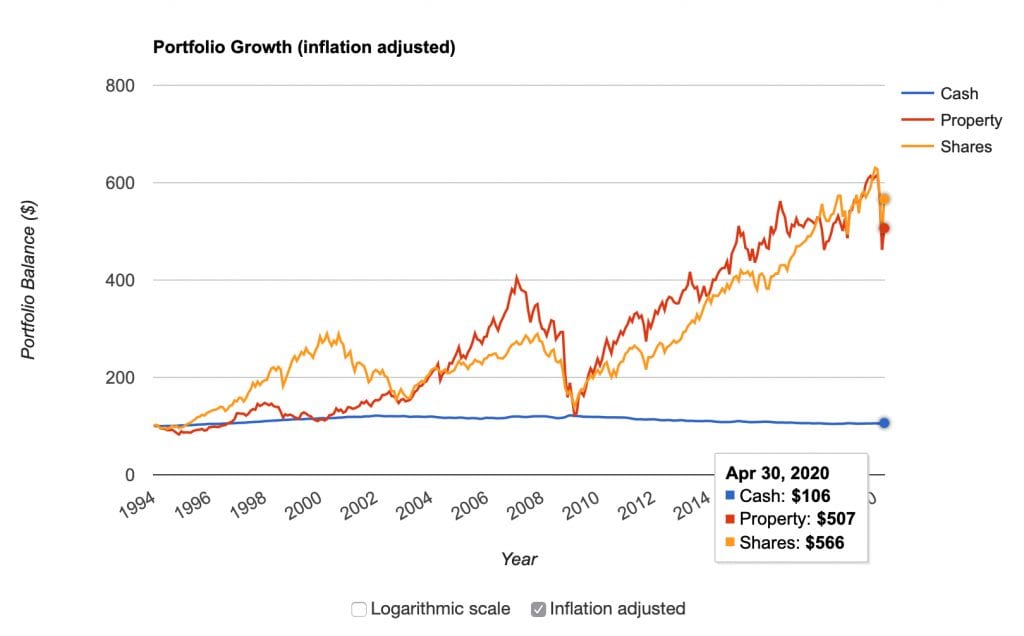

Here’s a graph that shows how the inflation adjusted returns of $100 invested in 1994.

Source https://www.portfoliovisualizer.com

As you can see in that timeframe property and shares have significantly outperformed cash.

Not convinced?

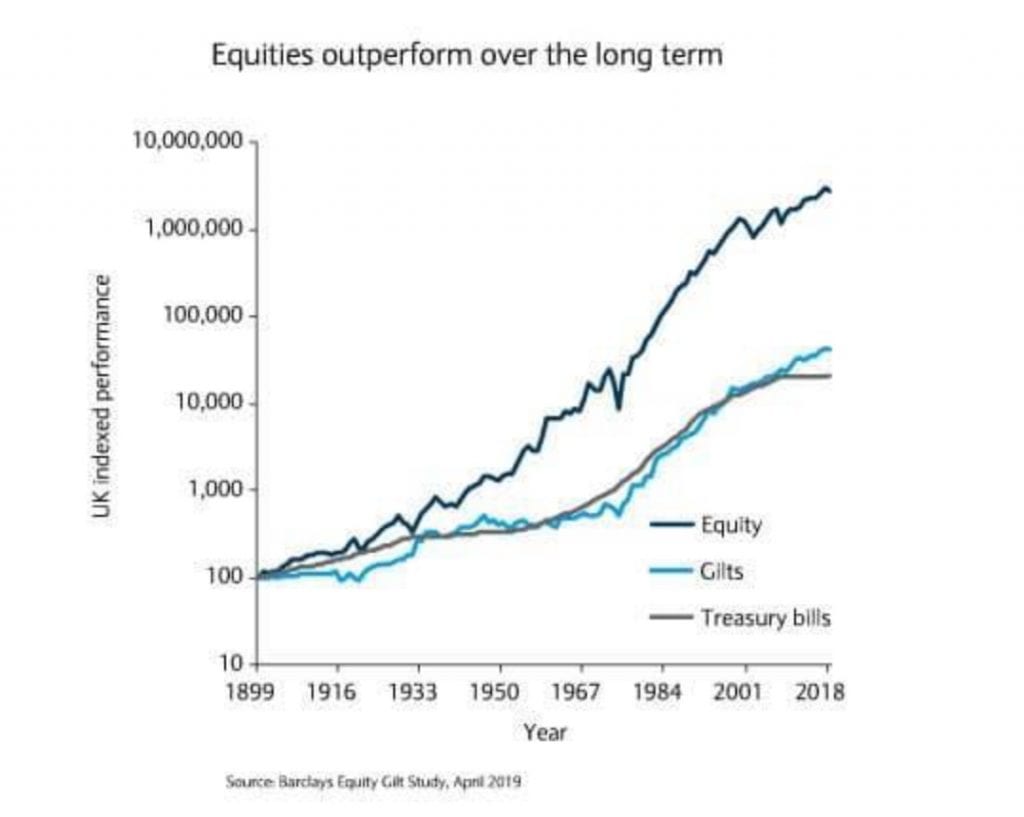

Well here’s another graph that shows the performance of £100 invested in 1899 in three different asset classes. Again it shows favourable performance for equities (see definitions below) and less favourable for cash.

Source https://privatebank.barclays.com/news-and-insights/2019/july/market-perspectives/market-counts/

Now you’ll see why my children don’t have piggybanks to save cash, but do have Junior Stocks and Shares ISAs holding a well-diversified, low cost portfolio.

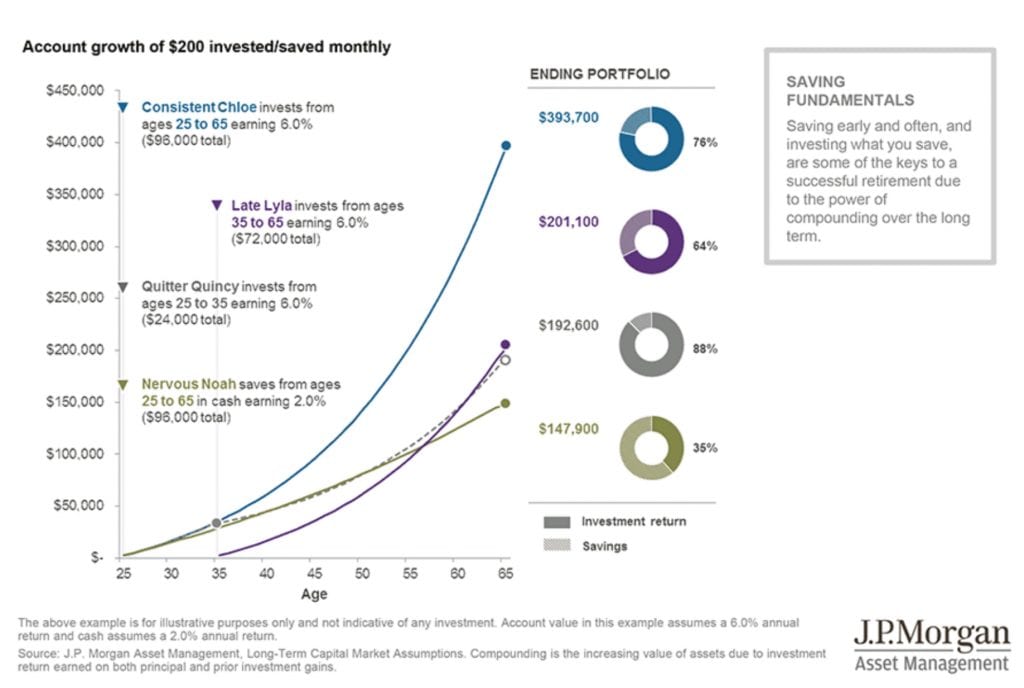

We already learned about compound interest with Dr Sophie’s lunch, but here’s a graph every doctor needs to see. It compares 4 people who invest $200 monthly. As you can see starting early makes a big difference to the outcome due to compound interest.

Source https://am.jpmorgan.com/us/en/asset-management/gim/per/insights/guide-to-retirement

If you are young enough (25) to be “Consistent Chloe” that’s great, start now. I wish I could have started earlier. More likely you’ll be “Late Lyla” and pay close attention to “Nervous Noah” who kept all his money in cash. Nervous Noah is the reason why we can’t just leave all our investments in cash.

Definitions

Like medicine there’s a confusing vocabulary around investing that once you learn can help to demystify what is essentially a simple concept – give some of your money to someone else and at the end they might give you back more, or less than you gave them at the start.

Shares – (stocks, equities) are units of a company that can be bought and sold and the value of the share fluctuates

Bonds – are a way of loaning money to the organisation issuing the bond, usually a government or a company. It’s effectively an IOU between the investor and whoever issued the bond. In the UK government issued bonds are called gilts, in the US they are called T-Bills.

Commodities – are physical assets such as precious metals, like gold, energy, like oil, or even agricultural assets like grain.

Funds – (Funds, Exchange traded funds, Investment trusts) are ways to buy a selection of investments. These can be actively managed by a fund manager who picks and chooses investments or passively managed, which simply track the performance of the market they are tracking.

So where to start?

Invest tax efficiently.

In week 1 we helped you to stop making unnecessarily charitable donations to the tax man by claiming tax allowances and reliefs. The good news is investing tax efficiently is very easy thanks to Individual Savings Account (ISA). There are many forms of ISAs, including Cash ISAs, Stocks and Shares ISAs, Lifetime ISA and Innovative finance ISA. They say life begins at 40, but unfortunately your eligibility for a Lifetime ISA ends at 40. So, if you are approaching 40 you might want to look into LISA sooner rather than later.

Understand risk.

Risk in relation to investing can be complex. The risk you’re probably most worried about with investment is investment risk, the risk you lose some or all of your money. But there’s also inflation risk – the risk that like Nervous Noah in the chart above you hold your wealth in cash and it is value is effectively reduced by inflation. Generally, the higher the risk, the greater the potential return. Understanding your own appetite for risk is essential to getting the correct investments for you. If you get your appetite for risk wrong, the first time your investments go down, you will panic.

Buy high, sell low is a recipe for losing money.

A good financial adviser will include a detailed assessment of your risk as part of your investment plan.

Reduce risk

Diversification

Time in the market

Pound cost averaging

Asset allocation

Holding a wide range of investments for a longer timeframe is a proven way to mitigate risk. Buying individual shares is extremely risky and a poor strategy for the amateur investor. Whilst you may get lucky occasionally, we are looking for consistent returns over a very long time and being consistently lucky is not a reliable investment strategy. Investing in funds provide an easy way to invest in many shares and diversify and mitigate some of that risk.

Pound cost averaging is another way to reduce risk. Instead of saving up £1,200 in cash then investing in a lump sum once a year, pound cost averaging means you would invest £100 a month over 12 months. IN some situations, this can help to smooth out market volatility and reduce risk.

Another key part of reducing risk is the asset allocation in your portfolio. Asset allocation describes how you split your investments amongst the various asset classes, cash, shares, bonds and property. Matching asset allocation to your risk and your goals is essential and something that a good financial adviser will help you with. If you are young, investing for the long term and happy to take significant risk, you might hold a portfolio mostly in equities (higher risk). As you get older you may be less tolerant of risk and therefore hold more bonds (lower risk) An oft quoted rule of thumb is

% of stocks in portfolio = 100 – age

So, for a 60-year-old they might hold 40% in equities.

Risk is a massive subject and understanding your tolerance for it and how you will mitigate it is essential for successful investing.

Minimise costs

Minimising costs is essential for successful investor. If you want to see what a 1% difference in costs looks like over a 30 year investment, have a play around with the compound interest calculator I mentioned in week 3. The costs of investing come from 4 areas

Fund costs

Active funds (see definitions) use experienced managers to try and pick the best investments. Despite this a majority, but not all, active funds still underperform the passive tracker funds, especially when taking into account the higher fees charged by active funds.

Platform costs

You will buy and hold your investments through a platform. These platforms charge varying fees for holding your investments. Research the costs carefully and be aware that the costs of holding the same fund can vary significantly depending on the platform.

Advice costs

At Medics’ Money we believe in good advice for the right price. Not only do we only recommend advisers that fulfil our rigorous criteria for quality (https://www.medicsmoney.co.uk/medics-money-approved/), but we also only recommend advisers that charge fair and transparent fees for advice.

But what is a fair price? Well the average fee that Medics’ Money advisers charge for setting up your investments is 3% of the investment or a fixed fee for larger investment amounts. If you want the adviser to look after your investments long term the ongoing management charges are at MAXIMUM 1%, with most significantly lower than this. If you have a large portfolio, you should expect a reduction in the % fees. None of the advisers on Medics’ Money charge any exit fees.

We are often approached by advisers who want to join Medics’ Money who charge extortionate fees for investments. Reasons to justify the high fees are numerous, but often include they have access to a “special range of funds that have superior returns”. None of them has ever provided evidence to support this claim and no adviser charging extortionate fees will ever be allowed to join Medics’ Money.

I have friends who happily pay £25 per week for a cleaner (£1,300 per year), but don’t want to pay a financial adviser £1,000 per year to manage their portfolio. I don’t pay for a cleaner, but I do have an adviser to oversee my investments. Which brings me to the final cost, your time. If you are going to manage your own investments, you are going to need to allocate significant time to doing so. For busy, high income, professionals like doctors, its highly likely that our time would be best spent earning money being a doctor or enjoying some downtime. As long as the advice you are paying for is the right advice, for a fair price.

Should I get advice?

If I give a stockbroker a stethoscope, they don’t become a doctor. If doctors are given a share trading account, they don’t become stockbrokers. Take advice from qualified individuals.

There’s nothing stopping you from opening a stocks and shares ISA right now and buying shares or funds. There’s also a wealth of information on the internet that could allow you to educate yourself on investing. You could invest in a well-diversified, low cost portfolio in a tax efficient wrapper like a stocks and shares ISA for 30 years and probably achieve reasonable returns. At Medics’ Money we encourage you to take control of your own finances and provide the resources to enable you to do this wherever possible. But for the vast majority of doctors looking to invest, it is our belief they would be better off taking professional advice. Unless you want to dedicate significant time to researching investing properly, the risks of poor returns, or even worse loss are significant. Research has shown that using an adviser can add up to 3% to returns. Interestingly these gains were largely realised by behaviour management and encouraging clients to stick to the plan. 1

This week’s goals

This week’s message is simple. Investing your money and compounding the returns over a long timeframe can facilitate financial freedom by being smart and not simply by working harder as a doctor. The sooner you start, the more compounding time you have and the sooner you can taste financial freedom. I strongly encourage you to get advice on investing, but if you are going to do it yourself, you need to do a lot more reading than I could cover here.

References

1 – Using an adviser can add 3% to your returns – https://www.vanguard.co.uk/documents/adv/literature/adviser-alpha-value-on-value-brief.pdf

Chapter 6

Essential pension housekeeping every doctor should do.

One of the best investments you can make? Not property, shares or even cryptocurrency ;-). No, it’s the NHS pension. There’s been a lot of publicity around the NHS pension recently and it’s not without its faults or pitfalls. But some doctors have opted out of the pension, often without taking proper advice. If you have opted out of the pension without taking proper financial advice, you need to get some advice IMMEDIATELY. For the VAST majority of doctors, the pension remains a valuable part of overall pay package and opting out should only be done in exceptional circumstances, after taking specialist advice.

Each year, the NHS provides each member of the scheme with a Total Rewards Statement (TRS) The TRS statement is the absolute minimum annual check ALL doctors should make on their pension. If you haven’t done so already, set up your TRS account now and check it carefully. It is easy to do online

https://www.totalrewardstatements.nhs.uk

When I set mine up in 2009, I noticed an error on my statement, which if not rectified, could have cost me thousands of pounds at retirement. Ever since then I have each annual TRS statement, up until 2016 when capita took over management of GPs’ pensions!

Get your TRS statement NOW. Check the figures VERY carefully. Mistakes in pension records are very common and unless you or your financial adviser spot them, they are likely to prove costly. Keep the TRS statement safe, it could be the only record you have of one of the best investments you can make.

Our blog contains a dedicated NHS pensions section

https://www.medicsmoney.co.uk/medical-accounting-blog/?catname=pensions

The NHS pensions website is a very good source of information

https://www.nhsbsa.nhs.uk/member-hub

This week’s goals

1 – This week may seem short, but it is VITAL you keep an eye on your pension. If you haven’t ever seen your TRS statement, that’s a red flag and you need to get the statement immediately.

2 – If you have opted out of the pension scheme without taking specialist advice, that’s also a red flag and you need to consult a specialist adviser immediately.

3 – Have a good read of the articles on our blog that help you determine whether you have a pensions tax charge.

https://www.medicsmoney.co.uk/medical-accounting-blog/?catname=pensions

Chapter 7

Final week. You made it. I have saved the most important subject until last. One of the primary motivations for starting Medics’ Money was to provide doctors access to high quality financial advice in a transparent way and for the right price.

Where to find good advice for the right price.

Despite cuts of up to 30% in some doctors pay over the last 10 years that we discussed way back in week 1, doctors are still well paid compared to the general population. This makes us an attractive target for all kinds of advisers and salespeople. Some of these salespeople may have even given a presentation to you at medical school or “free” lunch at your hospital. Your hospital or medical school surely wouldn’t allow barely qualified salespeople to give bad advice to you, would they? Well, having sat through these presentations, I can emphatically confirm, that had I taken the products offered to me at medical school, I would now be significantly worse off. Have a look at one example of how Medics’ Money advisers saved two of our colleagues over £10,000 in fees.

https://www.medicsmoney.co.uk/income-protection-for-doctors-getting-the-best-deal/

How do you find good advice? How do advisers charge fees? What is the difference between independent and restricted financial advice? What qualifications do advisers have? Why is a specialist medical accountant from Medics’ Money better than your mate’s brother who does accounts for IT contractors? Unlike Dr, “accountant” is NOT a protected title. In fact, you or I could start an accountancy firm tomorrow and call yourself an accountant despite not being qualified. The accountants on Medics’ Money are fully qualified specialist medical accountants carefully selected by us. We are unashamedly selective with who we recommend, selecting only the very best.

If you don’t want to learn the answers to all these questions, but simply want to know where to find sound financial advice for doctors, the answer is simple:

use Medics’ Money.

You could trust our 5* Google reviews, or institutions like the Royal College of General Practitioners, the Royal Medical Benevolent fund or Doctors.net.uk, that recommend Medics’ Money to their members. Or the hundreds of reviews on Medics’ Money left by GMC verified doctors.

But you’ve made it this far through your crash course in doctors’ finances, you might as well understand why Medics’ Money is the best place for doctors to find a financial adviser, accountant or mortgage that’s right for them.

Here’s some more information so you can be fully informed:

https://www.medicsmoney.co.uk/accountants-for-doctors-how-do-i-find-a-good-medical-accountant/

https://www.medicsmoney.co.uk/independant-financial-advisers-ifa-for-doctors/

https://www.medicsmoney.co.uk/income-protection-for-doctors-getting-the-best-deal/

The final thing I need to say is a massive

THANK YOU

to all those of you who have told your colleagues about Medics’ Money and helped us to empower our doctors to make better financial decisions. To those of you that proof read and made suggestions to improve “What medical school didn’t teach us about money” thank you. To anyone who has ever emailed us to say thanks, or suggest improvements, thank you.

Tell your friends and colleagues and everyone can download their own free copy of “What medical school didn’t teach us about money” here. INSERT LINK

Disclaimers

This document is for information purposes only and does not constitute advice. By using this document you accept the terms and conditions outlined here https://www.medicsmoney.co.uk/terms/ and https://www.medicsmoney.co.uk/privacy

Specifically you understand that

10.1 Nothing on this website constitutes or is intended to constitute:

(a) a financial promotion, an advertisement for any particular investment or investment business, or an invitation or inducement to engage in investment activity;

(b) investment advice, including advice on the merits of buying, selling, subscribing for, underwriting or exercising rights in relation to a particular security or investment;

(c) the making of an arrangement for another person to buy, sell, subscribe for or underwrite a security or investment; or

(d) any financial service or activity regulated or controlled by or pursuant to UK financial services law or any other applicable law.

10.2 You should take professional financial advice in connection with, or independently research and verify, any information that you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

10.3 We would like to draw your attention to the following investment warnings:

(a) the value of shares and investments and the income derived from them can go down as well as up;

(b) investors may not get back the amount they invested; and

(c) past performance is not necessarily a guide to future performance.

10.4 We are not regulated under UK financial services law.