What medical school didn’t teach us about money” gives doctors a step by step plan to transform their financial future.

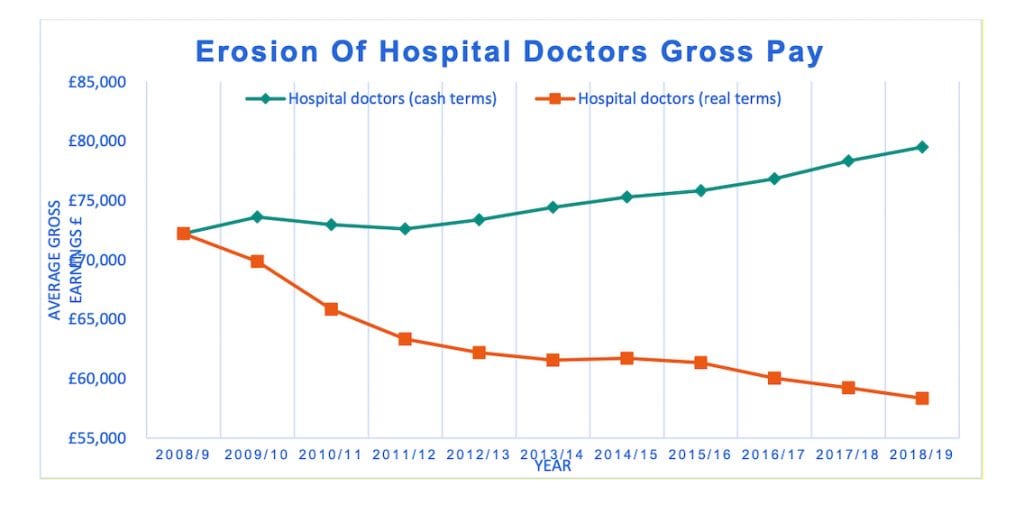

Over the last 10 years some doctors pay has dropped 30% in real terms, according to the BMA. If, like me you live in an area with a high cost of living, like London or the southeast, it’s likely the problem is even worse. Add in the rising cost of medical school and the increasing pension contributions with punitive taxation it’s clear that now, more than ever, doctors of all ages need to be financially astute.

Enter your details to download your copy now

Here’s a preview of what to expect from your free copy of

What medical school didn’t teach us about money

What medical school didn’t teach us about money

By Dr Tommy Perkins, NHS GP and Medics’ Money co-founder

So, you’ve been a doctor a few years, earn a decent wage, but still your bank account is empty at the end of the month? Do you struggle to pay those expensive post graduate exam courses and fees? Perhaps you are trying to save for a wedding, mortgage or school fees. Or maybe you’ve been a doctor for many years and have minimal savings and few assets. You might even have been hit by a tax bill you couldn’t pay and didn’t really understand. You are not alone.

The downward spiral of doctors pay

Over the last 10 years some doctors pay has dropped 30% in real terms, according to the BMA 1. If, like me you live in an area with a high cost of living, like London or the southeast, it’s likely the problem is even worse. Add in the rising cost of medical school and the increasing pension contributions with punitive taxation it’s clear that now, more than ever, doctors of all ages need to be financially astute.

Real terms pay cuts for doctors is only half the story

The other half of the story is what medical school didn’t teach you or me about money. As doctors we receive plenty of medical education, but almost no financial education. Unfortunately, this trend continues throughout our careers. What little financial CPD we do receive, often comes from poorly qualified salespeople who put their own interests above yours.

With all of this against us, it’s no wonder we can struggle with our finances. Mastering our finances is not difficult. Doctors are intelligent people and if you empower yourself with the right information you can take control your financial future. Once you do that, you can become financially independent – no longer reliant on working 70-hour weeks or doing locum shifts to make ends meet. Financial independence will give you the choice to work when and how you want and in my personal experience, that has made me a better doctor.

By downloading this free ebook, I will show you how Medics’ Money can give you the financial CPD you need and help you fight back against this downward spiral of doctors pay and to improve your own financial health.

This will include how to:

- Develop your SMART ‘Financial Personal Development Plan’ (fPDP)

- Maximise income

- Minimise unnecessary expenditure

- Build a moat to protect you and your family

- Repay your debts

- Grow your wealth

- Get good advice