I’ve sent you an email with a link to download “What medical school didn’t teach us about money”

Occasionally these emails go to spam folder or gmail promotions tab and if that happens make sure you add [email protected] to your contacts.

You are joining a community of over 26,000 doctors who use Medics’ Money to empower themselves to make better financial decisions.

Sometimes the email takes a few minutes to arrive, so I’ve included Chapter One below.

Chapter One – the downward spiral of doctors pay and how to beat it

So, you’ve been a doctor a few years, earn a decent wage, but still your bank account is empty at the end of the month? Do you struggle to pay those expensive post graduate exam courses and fees? Perhaps you are trying to save for a wedding, mortgage or school fees. Or maybe you’ve been a doctor for many years and have minimal savings and few assets. You might even have been hit by a tax bill you couldn’t pay and didn’t really understand. You are not alone.

The downward spiral of doctors pay

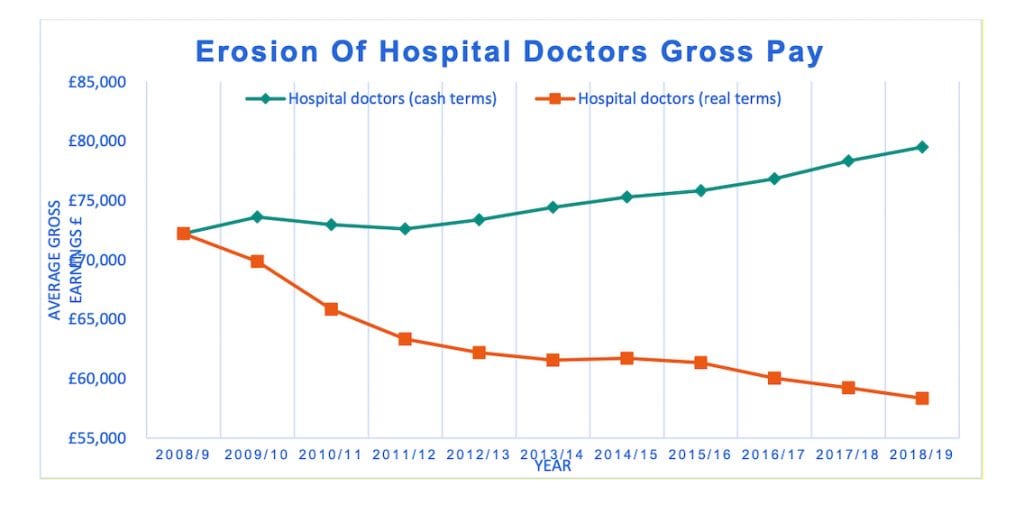

Over the last 10 years some doctors pay has dropped 30% in real terms, according to the BMA 1. If, like me, you live in an area with a high cost of living, like London or the southeast, it’s likely the problem is even worse. Add in the rising cost of medical school and the increasing pension contributions with punitive taxation and it’s clear that now, more than ever, doctors of all ages need to be financially astute.

From BMA https://www.bma.org.uk/media/2123/bma-ddrb-submission-2020.pdf

Real terms pay cuts for doctors is only half the story

The other half of the story is what medical school didn’t teach you or me about money. As doctors we receive plenty of medical education, but almost no financial education. Unfortunately, this trend continues throughout our careers. What little financial CPD we do receive, often comes from poorly qualified salespeople who put their own interests above yours.

With all of this against us, it’s no wonder we can struggle with our finances. Mastering our finances is not difficult. Doctors are intelligent people and if you empower yourself with the right information you can take control of your financial future. Once you do that, you can become financially independent – no longer reliant on working 70-hour weeks or doing locum shifts to make ends meet. Financial independence will give you the choice to work when and how you want and in my personal experience, that has made me a better doctor.

Over the next few pages, I will show you how Medics’ Money can give you the financial CPD you need and help you fight back against this downward spiral of doctors pay and to improve your own financial health.

This will include how to:w

- Develop your SMART ‘Financial Personal Development Plan’ (fPDP)

- Maximise income

- Minimise unnecessary expenditure

- Build a moat to protect you and your family

- Repay your debts

- Grow your wealth

- Get good advice

Firstly, well-done for finding Medics’ Money and subscribing to this email. You’ve taken the first step to financial freedom and by completing the action steps at the end of each week you will begin the path to financial freedom.

My journey to financial enlightenment

I was the first of my family to attend university and I had crippling debts of around £85,000 when I graduated as a doctor in 2008. This forced me to learn how to manage my finances. Like many of you, I’d never received any formal financial training. I was however subjected to “free” lunchtime talks from barely qualified salespeople, looking to exploit my financial naivety and potential earning capacity. I realised pretty quickly I needed a financial personal development plan (fPDP). 12 years later, I’m now debt free (except for mortgages) and have started to build up some assets and investments for my young family, crucially whilst also maintaining a work life balance. If you managed not to accrue debt at medical school, well done, you are ahead of many of your peers. But you need to capitalise on this position. Over the next few pages, I’m going to help you learn what medical school didn’t teach us about money. If like me it’s a while since you left medical school, this information is even more relevant to you as, you have less time until retirement and less time to recover from any mistakes. Here at Medics’ Money we practice Primary, Secondary and Tertiary prevention for doctors’ financial health. So, if like me, you already have a few financial scars don’t worry: we can help you.

Let’s take this step by step. First up, like your appraisal, let’s start by developing your financial Personal Development Plan (fPDP).

As doctors we are about as goal driven as it gets and we’re also incredibly good at achieving these goals. But when did you last set a financial goal? What are your financial priorities for the next 5 years? Longer term, do you want to work to state retirement age – currently 68 for me. Or do you want to achieve financial independence so you can choose when and how you work? I’m only 38 but I know right now I do not want to work full time to 68 years of age and a good chunk of my personal fPDP is geared to making that possible.

I bet you have a PDP as part of your appraisal, but what’s your financial PDP (fPDP)?

Everyone’s fPDP goals will be unique to them. It can be as simple as paying off credit cards, starting to invest, saving for a house deposit, investing in training to improve your income or send your children to a private school. I like to break goals down into short, medium, and long-term goals. Specific, Measurable Attainable, Relevant, Time bound (SMART) goals are useful, but you already knew that thanks to the joy of appraisal.

Your fPDP will contain many goals. For example

S – Save £10,000 for a house deposit.

M – If I save 20% of my income each month, I will have £10,000 in two years.

A – My income as Dr is stable and saving the £10,000 doesn’t rely on unreliable events like locum work or winning at blackjack. I have setup a separate savings account and a monthly transfer to ensure I save the money not spend it. (an example of pay yourself first, more detail below.)

R – Although ambitious to save 20% I have analysed my spending, made some savings for example by not wasting £7 buying lunch every day.

T – I will review progress monthly to check I’m reaching my target of 2 years to save £10,000.

Whatever you do, write it down. We have our family fPDP in a word document along with a spreadsheet that we use to track our expenses, investments and other financials.=

If you have a partner or, like me, a family then this planning should be done together for many reasons.

Reasons to fPDP as a family

- Engagement – if everyone’s contributed to the plan and agrees the goals contained in it then everyone’s engaged.

- Tax – if you have a partner or family you may be able to spread the tax burden out across the family using various allowances and reliefs.

- Strengthening relationships – if tough financial decisions need to be made, then making them together rather than forcing them upon the rest of the family is best.

- Educating your children – the sooner your children learn the basics of money management, the sooner they can be financially free. You can be their financial role model.

- Reforming a high spending spouse – in any relationship, its likely one of you will be more frugal and this can lead to conflict. My wife is more frugal than me and doing our fPDP together helps to temper my occasionally impulsive desires for new surfboards or bikes.

Calculate your net worth

Calculating your net worth is an essential part of your fPDP and one of the benchmarks you will use over time to measure its success is your net worth. Your net worth is simply:

£Net worth = total assets – total liabilities

Your assets may include things like equity in any property, cash, investments and pensions.

Liabilities are debts. Try not to get bogged down in the details of what should and shouldn’t be included. As long as you keep what you include in the calculation consistent year to year then you will have a method of tracking your success.

At least annually, recalculate to track your progress. Is your net worth a positive number? If so, well done – you are ahead of where I was at the start of my career! But if you want financial freedom you are going to need a VERY positive net worth to facilitate that.

How will you attain your goals?

If you’ve simply put “save up money” that is unlikely to be successful. Like patients whose plan is “just stop smoking” you know it’s unlikely to work. You need a specific, detailed, well thought out plan on how you will achieve your financial goals.

I’ve found the help of a qualified Independent Financial Adviser (an IFA) invaluable here as they can delve deep into your finances and help you make a realistic, attainable plan.

Each week we will set some goals to keep you on track. Simply reading this document is not enough, you need to act on the information it contains to secure your financial future.

Week one goals

- Step 1 – Calculate your net worth

- Step 2 – Develop your fPDP goals. Do this with your partner or family if applicable

- Step 3 – Have a think about your long-term goals

Do all the goals on your fPDP involve more money? Now, you could simply work harder to get more money. Or you could maximise the income you already have, without doing more work

And that’s what we will look at next: maximising income.

Check your emails to read the next chapter and if its gone to spam add [email protected] to your contacts.