Doctors get plenty of Clinical CPD teaching, but almost NO financial CPD teaching.

Could this lack of financial education be costing doctors, dentists and other healthcare professionals £100,000 pounds?

NO, it’s more likely costing you £1.2 million pounds in lost wealth.

In the following example we’re going to show you how Medics’ Money can help you avoid financial mistakes that cost one doctor over £1.2million pounds.

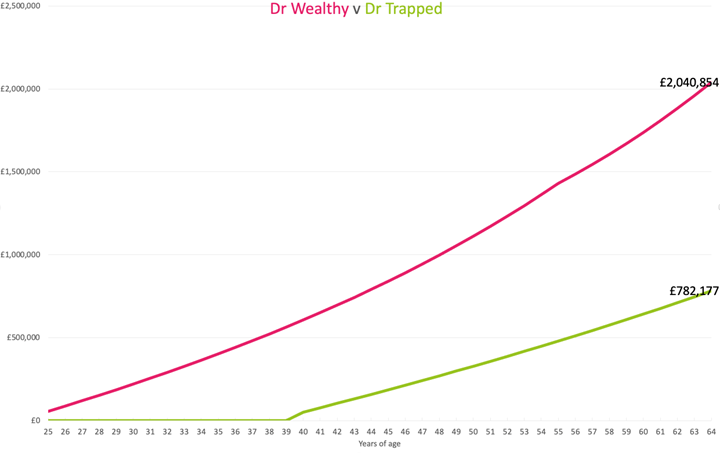

This graph shows the Net worth of two doctors, Dr Wealthy and Dr Trapped.

If you’re not aware, Net worth is a measure of your wealth and is simply:

What you OWN (assets like investments, properties and cash) MINUS what you OWE (debts like mortgage, loans) = £Net worth.

Would it surprise you to know that Dr Wealthy and Dr Trapped graduated from the same medical school, at the same time and for the first 15 years of their career, they earned THE same amount of money (thanks to standardised NHS Pay scales)?

How is Dr Wealthy so much wealthier than Dr Trapped?

How did Dr Wealthy build so much wealth that after just 15 years as a doctor, she was able to work LESS than Dr Trapped?

How did Dr Wealthy retire 5 years earlier than Dr Trapped and on a HIGHER Pension?

Well, this table gives you a summary of how, but if you want the details keep scrolling down.

| Dr Wealthy | Dr Trapped | ||

| Money mindset | Has clear financial goals and knows how to achieve them | ✅ | ❌ |

| Maximises current income to grow wealth from existing earnings | ✅ | ❌ | |

| Spending | Has a budget | ✅ | ❌ |

| Spends less than earns | ✅ | ❌ | |

| Debt management | Pays off bad debt | ✅ | ❌ |

| Avoids accruing any more bad debt | ✅ | ❌ | |

| Tax | Utilises legitimate tax deductions | ✅ | ❌ |

| Uses expert advice where needed | ✅ | ❌ | |

| Investing | Understands how to invest | ✅ | ❌ |

| Has an investing strategy | ✅ | ❌ | |

| NHS Pension | Understands the value of the NHS Pension and how to maximise the benefit | ✅ | ❌ |

I’m Dr Ed Cantelo, a Dr and a Chartered Accountant and Chartered Tax adviser and I’m Dr Tommy Perkins, a GP. Coming from humble backgrounds and utilising our unique skillset we became expert in managing money. Sorting our own finances gave us the freedom to work less as doctors, so in 2014 we started Medics’ Money and began helping our doctor colleagues improve their finances.

Want to know Dr Wealthy’s secret?

Fill in your details below and we’ll email you a comprehensive guide to Dr Wealthy’s secrets to success, including details of HOW she was became a double millionaire.

SPOLIER – there’s no get rich quick schemes, just good financial habits compounded over many years.

You’ll be joining >50,000 doctors, dentists, nurses and other medics who use Medics’ Money to improve their financial future. No Spam. Unsubscribe at any time.

Sounds too good to be true?

Although this is a hypothetical scenario, the numbers and calculations are real. We’ll send you Dr Wealthy’s tips when you signup (it’s free) but if you’re already looking for quick fixes, here’s the big takeaways.

Dr Wealthy has a system to grow her wealth

Good financial habits like using pay yourself first, paying off bad debts and not wasting her hard earned money mean Dr Wealthy rapidly starts to turn her income into wealth generating assets.

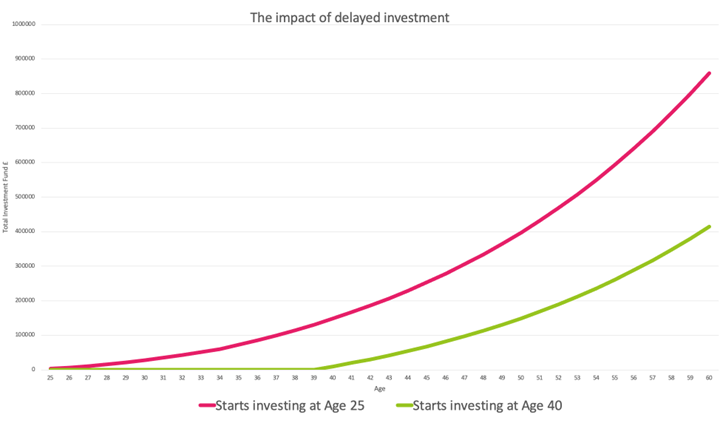

Dr Wealthy understands how to harness the power of compound interest and by investing early (aged 25) she is able to massively outperform Dr Trapped, who starts investing aged 40. If you are aged 40 or more and not investing, don’t panic but do act.

Our guide shows you how to get started with investing and you can download it here.

Dr Wealthy maximises her NHS Pension

Dr Wealthy took time to understand her NHS Pension and this allows her to extract the maximum benefit from it whilst avoiding punitive pension tax charges.

Dr Wealthy retires aged 58, 5 years before Dr Trapped who is forced to work until 63.

Incredibly Dr Wealthy also has a HIGHER annual pension, £54,709 v Dr Trapped with £52,117.

Sound too good to be true? Download Dr Wealthy’s guide to learn how you can do this.

Dr Wealthy is financially independent, no longer reliant on working long hours as a doctor. Dr Trapped has no other incomes so has to work harder for longer and ends up less wealthy than Dr Wealthy.

Dr Wealthy is able to translate her income into wealth producing assets such as stocks and shares and property. This extra wealth means Dr Wealthy has the financial freedom to work less than Dr Trapped. Dr Wealthy reaches financial independence, that is the point where she is no longer reliant on her NHS income, over a decade earlier than Dr Trapped.

There’s no shortcuts to getting wealthy but with some simple financial education you can live the live you deserve. Start your financial independence journey today and download Dr Wealthy’s guide to Financial Freedom today.