When did you last check through your bank account with as much diligence as you check your patients test results?

by Dr Tommy Perkins, Medics’ Money founder and NHS GP.

Do you know what your monthly outgoings are? How much do you waste per month on non-essentials, like that cup of coffee at the station each day. If you have student debt, credit card debt or savings goals then you need to try and continue spending like a student – frugally. Even if you don’t have any debt, it’s still important to set a budget and not waste your hard-earned money.

11 years ago when I was an FY2, I used to frame any planned expenditure in

“number of post-take ward rounds needed to earn money to buy item x.”

When you frame costs in these terms, I guarantee you will save money!

Sit down with last few month’s bank statement and carefully go through your expenditure. Do you really need those monthly subscriptions? Could you spend less and still enjoy life? How many times did you buy lunch in the last month? A packed lunch is always cheaper and often better than hospital food. The greater your debt, the more scrupulous you will need to be. Budgeting is a prospective exercise, so once you’ve analysed your spending retrospectively, set a realistic prospective budget.

Sophies hospital lunch bill of £139,680?

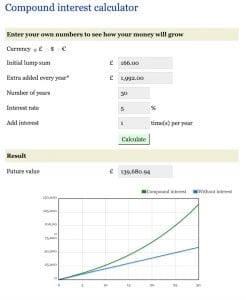

If you need motivation for how small amounts of unnecessary spending add up, compound interest is it. Einstein reportedly described compound interest as the 8th wonder of the world and its certainly the first wonder of the financial world. Let’s use the example of Sophie, an ST7 in Cardiology who discovered Medics’ Money site a year ago and used our free resources to transform her financial future. Sophie was busy preparing to CCT, finishing her PHD and job hunting, so she didn’t have time to make a packed lunch. Soon she realized she had been spending £200 per month in the hospital canteen. So she committed to making a packed lunch and trimmed her spend by £166 per month. If Sophie continued to save this money and re-invested for the rest of her 30-year career as a doctor how much would she have saved?

£59,760 right? (£166 times 12months times 30 years ) Wrong.

It’s likely to be £139,680. This assumes an average return of 5% on the income being invested, which historically is possible with a long-term well-balanced portfolio.

I don’t like to say never, but I will say I will NEVER have a hospital lunch that was worth £139,680! If you need motivation that small cuts in your spending, get big results if managed well over the long term, then have a play around with the various compound interest calculators available online.

From https://monevator.com/compound-interest-calculator/

Minimising unnecessary expenditure generates cashflow to facilitate reducing debt, saving up an emergency rainy day fund, or to grow as investments. You can take this minimising of expenditure as far as you like, it’s a personal decision. I’m not going to list all the ways you can trim your excess spending, but think about big wins first like minimising household bills, regularly reviewing your mortgage deal and insurance, avoiding high transport costs and expensive car leases; the list is almost endless.

Write it down so you can track it and spot any anomalies. When I started in 2008, spreadsheet was the only option and that’s what I continue to use. But now there are many online dashboards to help you track your spending

https://www.moneydashboard.com

Recently my bank has released software that can help to track your spending.

On our family financial spreadsheet we split household bills down by essential spending like utility bills etc and non-essential spending, like holidays, bikes and surfboards. Whilst I may consider bikes and surfboards essential spending, unfortunately my wife does not! Always focus on minimising essential spending very thoroughly. Review your utility bills annually and shop around for the best price. Your boiler doesn’t know if it’s being fed expensive gas or the cheapest gas on the market – it all burns the same. Even bills that seem non-negotiable may not be so. A Medics’ Money reader emailed me to say he’d saved several thousand by renegotiating his council tax bill. More info on that here https://www.moneysavingexpert.com/reclaim/council-tax-bands-change/#overpaying

Get paid to spend money.

Cashback credit or debit cards pay you a small % of any money you spend. I use cashback or reward credit or debit cards for all spending, which I repay in full each month. Consulting my latest statements, this strategy earned me nearly £800 last year. This feels particularly sweet, because for too many years after medical school, I was forced to use credit cards and accrue expensive debt, which is the worst kind of debt to carry.

Pay yourself first to minimise the pain.

If you identify some savings that need to be made, pay yourself first is a great way to do it. Personally, I don’t do well with ultra-restrictive budgeting. Like crash diets, it just doesn’t work for me. I feel trapped and guilty for any money that I do spend and it makes me miserable. But pay yourself first does work well for me. Pay yourself first means, each month before you even touch your wages, pay out the savings amount you committed to. Put this money in a separate account and do this automatically each month. Then the rest of what you have left after paying bills etc is your money to enjoy and you can spend it guilt free. By making automatic payments every month, you will achieve e your savings goals automatically and automatically saving money is always good.