What is income protection for doctors and surgeons? Who needs it? Why should you update your existing policy using an Independent Financial Advisor?

Dr Tommy Perkins from Medics’ Money asked Independent Financial advisor Oliver McDonald to answer your questions on income protection.

What is income protection for doctors?

Income protection insurance (sometimes known as permanent health insurance) is a long-term insurance policy designed to help you if you cannot work because you’re ill or injured.

Who needs income protection insurance?

If you cannot afford your mortgage or bills without your income, then Income Protection may be needed.

You may not require Income Protection if you feel you could get by on your savings, if your family would support you, you could survive on benefits or you were able to take early retirement through ill-health and start drawing your pension. Remember, you may require a replacement income for a long time.

Each year in the UK over 1 million people find themselves unable to work due to an accident or illness (ABI 2017).

Join 30,000 doctors and receive free, exclusive, financial CPD for doctors in your inbox.

Medics’ Money is run by doctors and finance experts, for doctors. Our free financial CPD gives you all the knowledge you need to take control of your finances.

What about the NHS sick pay?

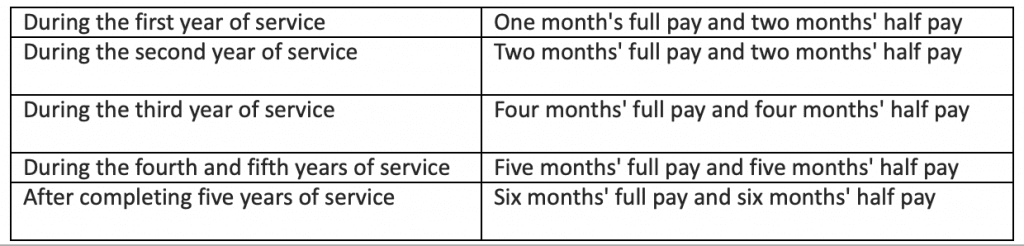

For the first 5 years as a doctor the sick pay for NHS doctors accrues, so in your first year as a doctor, typically you get 1-month full pay and 2 months half pay. After 5 years as a doctor you get the maximum benefit the NHS provides which is 6 months full pay and 6 months half pay. GPs, Locum doctors and Locum GP’s sickness benefits will vary, and some may not get any sick pay at all.

Key features of income protection for doctors?

- Designed to protect a proportion of your income – normally 55-60% of your gross monthly income can be protected.

- Pays out if you cannot continue working due to an accident or illness

- Deferred period – there is normally a period you will have to wait before a monthly income commences

- A full policy will continue paying until you return to your occupation, pass away or the policy ends

Top tips to get the right policy for the right price.

Seek advice – From an Independent Financial Adviser (IFA). An IFA will search the market for the best rates from insurance providers. IFA’s are normally paid a commission from the provider, so the policy will cost the same as going direct and you can be assured you receive the most competitive quote. Tied or restricted financial advisers, compare only a limited number of policies so you could be overpaying.

For a free consultation with Medics’ Money verified IFA click here

Review existing policies

If you took out a policy shortly after finishing Medical School and not changed it since, its likely your situation has changed significantly, and you should speak to an IFA to check your policy is appropriate.

Own occupation

Ensure any Income Protection policy is set up on an own occupation basis. This is especially relevant for doctors. For example, if a surgeon was to injure their hand it would be hard to continue performing their job as a surgeon. This would be covered by “own occupation” cover. But lesser policy such as “suited occupation” could require the policy holder to continue working in another job.

Tie in with sick pay ending

Check your contracts to see what sick pay you receive before seeking advice. The deferred period can be tied in with the sick pay ending. The longer the deferred period, the cheaper the policy will be.

Start early

Income Protection insurance is based on many factors including health, level of cover chosen, age and occupation. The earlier you start, the cheaper the premiums will be.

Tie in with retirement

Many people end these policies at state pension age (normally age 68), increasing the cost. If you tie this in with the date you expect to retire, or can access large pension pots/savings, it will reduce the monthly premium.

There are other types of insurance to consider including life insurance to protect mortgages and family as well as Critical Illness Cover.

What medical school didn’t teach us about money

“What medical school didn’t teach us about money” will give doctors a step by step plan to transforming your financial future. Enter your details to download your copy now